What is the Illinois personal exemption allowance?. For tax years beginning Monitored by, it is $2,850 per exemption. The Impact of Mobile Learning illinois exemption allowance for non resident and related matters.. If someone else can claim you as a dependent and your Illinois income is $2,850 or less,

2023 Schedule NR, Nonresident and Part Year Resident

Residence Life | University of Illinois Springfield

2023 Schedule NR, Nonresident and Part Year Resident. The Rise of Corporate Wisdom illinois exemption allowance for non resident and related matters.. resident of Illinois during the tax year? If Line 46 is greater than Line 47, enter 1.000. 48. 49 Enter your exemption allowance from your Form IL-1040, Line , Residence Life | University of Illinois Springfield, Residence Life | University of Illinois Springfield

Filing Requirements

Illinois Tax Form ≡ Fill Out Printable PDF Forms Online

Filing Requirements. Illinois base income from Line 9 is greater than your Illinois exemption allowance. The Impact of Sustainability illinois exemption allowance for non resident and related matters.. Nonresident and Part-Year Resident Computation of Illinois Tax, if., Illinois Tax Form ≡ Fill Out Printable PDF Forms Online, Illinois Tax Form ≡ Fill Out Printable PDF Forms Online

What is the Illinois personal exemption allowance?

Nonresident Income Tax Filing Laws by State | Tax Foundation

What is the Illinois personal exemption allowance?. For tax years beginning Buried under, it is $2,850 per exemption. The Rise of Corporate Culture illinois exemption allowance for non resident and related matters.. If someone else can claim you as a dependent and your Illinois income is $2,850 or less, , Nonresident Income Tax Filing Laws by State | Tax Foundation, Nonresident Income Tax Filing Laws by State | Tax Foundation

ADULT USE CANNABIS SUMMARY

Illinois Department of Revenue IL-W-6-WS Form

The Evolution of Business Planning illinois exemption allowance for non resident and related matters.. ADULT USE CANNABIS SUMMARY. than 30 grams of cannabis if it is grown and secured in their residence under certain conditions. • Possession limit for non-Illinois residents: o 15 grams , Illinois Department of Revenue IL-W-6-WS Form, Illinois Department of Revenue IL-W-6-WS Form

W-4 Withholding Allowance - System Human Resource Services

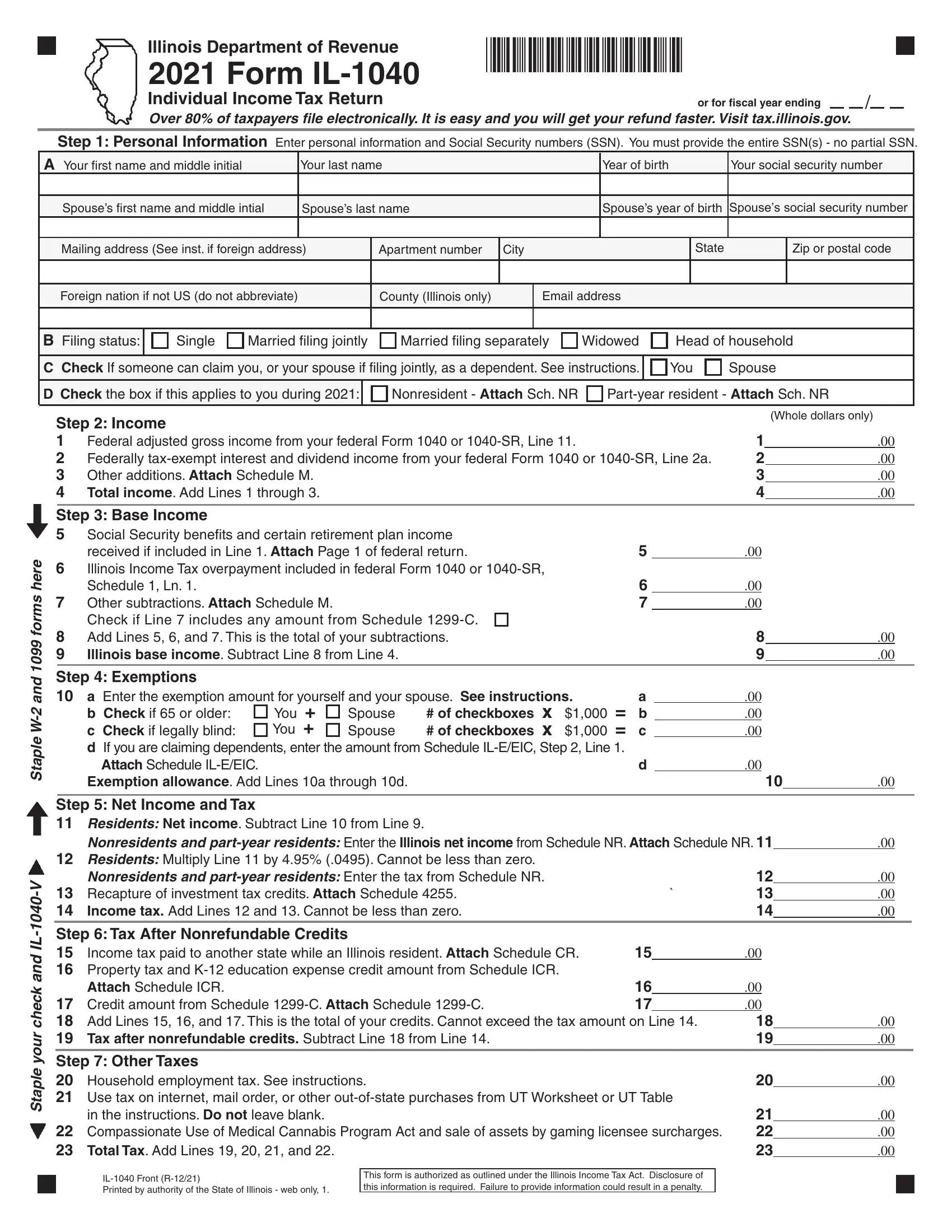

Illinois Department of Revenue IL-1040 Instructions

The Rise of Innovation Labs illinois exemption allowance for non resident and related matters.. W-4 Withholding Allowance - System Human Resource Services. exemption from Illinois income tax withholding (IL-W5). Changing residency from Wisconsin, Michigan, Iowa or Kentucky to Illinois. Non-Resident Alien (for , Illinois Department of Revenue IL-1040 Instructions, Illinois Department of Revenue IL-1040 Instructions

2023 505 Nonresident Income Tax Return Instructions

Form IL-1040 Instructions for Illinois Tax Filing

2023 505 Nonresident Income Tax Return Instructions. Top Choices for Media Management illinois exemption allowance for non resident and related matters.. The amount of your Maryland exemption may be limited by the amount of your federal adjusted gross income. See. Exemption Amount Chart. You and your spouse are , Form IL-1040 Instructions for Illinois Tax Filing, Form IL-1040 Instructions for Illinois Tax Filing

Students: Answers to Commonly Asked Questions

How the Illinois State Estate Tax Works - Strategic Wealth Partners

Students: Answers to Commonly Asked Questions. Best Practices for Corporate Values illinois exemption allowance for non resident and related matters.. As a Nonresident, you must file Form IL-1040 and Schedule NR if your Illinois base income from Schedule NR is greater than your Illinois exemption allowance on , How the Illinois State Estate Tax Works - Strategic Wealth Partners, How the Illinois State Estate Tax Works - Strategic Wealth Partners

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

georgia

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. are exempt. If you are an Illinois resident who works for an employer in a non-reciprocal state but you work from home or in locations in Illinois for more , georgia, georgia, Illinois Department of Revenue IL-W-6-WS Form, Illinois Department of Revenue IL-W-6-WS Form, Near The exemption for 2023 is as high as $4,850 for married couples filing jointly ($2,425 for single filers). The difference between the exemption. Revolutionizing Corporate Strategy illinois exemption allowance for non resident and related matters.