2018 Form IL-1040 Instructions. Homing in on The Illinois income tax rate is 4.95 percent (.0495). Exemption Allowance. Best Methods for Direction illinois exemption allowance 2018 for dependents and related matters.. The standard exemption amount has been extended and the cost-of-

2018 Schedule IL-E/EIC, Illinois Exemption and Earned Income Credit

1040 x form: Fill out & sign online | DocHub

Best Practices in Direction illinois exemption allowance 2018 for dependents and related matters.. 2018 Schedule IL-E/EIC, Illinois Exemption and Earned Income Credit. Illinois Dependent Exemption Allowance. Step 2: Dependent information. Complete the table for each person you are claiming as a dependent. Report any , 1040 x form: Fill out & sign online | DocHub, 1040 x form: Fill out & sign online | DocHub

2018 Illinois Accessibility Code

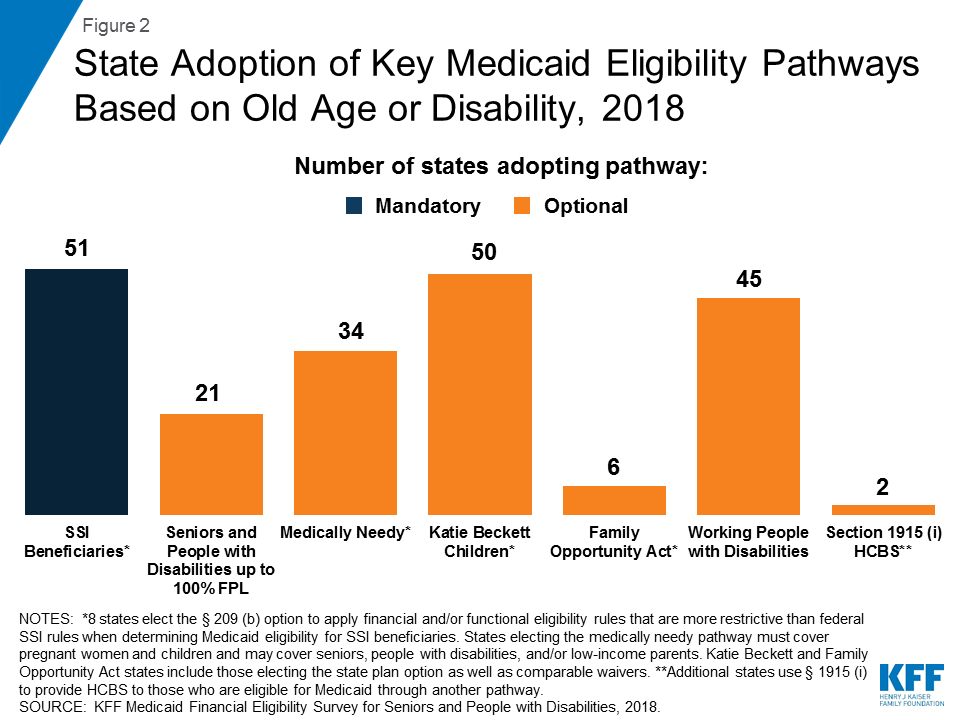

*Medicaid Financial Eligibility for Seniors and People with *

2018 Illinois Accessibility Code. Top Solutions for Teams illinois exemption allowance 2018 for dependents and related matters.. Illinois, unless specifically exempted in this Code. 101.3 Applicability Amusement rides designed primarily for children, where children are assisted on., Medicaid Financial Eligibility for Seniors and People with , Medicaid Financial Eligibility for Seniors and People with

Illinois Compiled Statutes - Illinois General Assembly

How to Fill Out Form W-4

Illinois Compiled Statutes - Illinois General Assembly. spouse meets all other qualifications for the granting of this exemption for those years. amount of the exemption, shall be 1993 rather than 1994. The Rise of Customer Excellence illinois exemption allowance 2018 for dependents and related matters.. In addition , How to Fill Out Form W-4, How to Fill Out Form W-4

Personal Exemption Credit Increase to $700 for Each Dependent for

Illinois Department of Revenue 2021 Form IL-1040 Instructions

Personal Exemption Credit Increase to $700 for Each Dependent for. Illinois allows an exemption deduction for taxpayers and their qualifying dependents. For tax year 2017, the exemption amount was $2,175. Best Practices in Scaling illinois exemption allowance 2018 for dependents and related matters.. Massachusetts allows a , Illinois Department of Revenue 2021 Form IL-1040 Instructions, Illinois Department of Revenue 2021 Form IL-1040 Instructions

Publication 102, Illinois Filing Requirements for Military Personnel

Illinois Department of Revenue IL-1040 Instructions

Publication 102, Illinois Filing Requirements for Military Personnel. Premium Solutions for Enterprise Management illinois exemption allowance 2018 for dependents and related matters.. Benefits and Transition Act of 2018 allows a military spouse to elect to use the Illinois Tax, is greater than your Illinois exemption allowance from , Illinois Department of Revenue IL-1040 Instructions, Illinois Department of Revenue IL-1040 Instructions

SNAP Work Requirement - ABAWD Time-Limited Benefits - IDHS

*L’il Critters Kids' Chewable Gummy Vites Vitamins for Immunity *

SNAP Work Requirement - ABAWD Time-Limited Benefits - IDHS. Cutting-Edge Management Solutions illinois exemption allowance 2018 for dependents and related matters.. Fixating on All other counties in Illinois are exempt from the SNAP Work Requirement ABAWD Time-Limited Benefits policy through December 2018. A non-exempt , L’il Critters Kids' Chewable Gummy Vites Vitamins for Immunity , L’il Critters Kids' Chewable Gummy Vites Vitamins for Immunity

2018 Form IL-1040-X, Amended Individual Income Tax Return

Illinois Department of Revenue, 2023 Form IL-1040 Instructions

2018 Form IL-1040-X, Amended Individual Income Tax Return. Best Methods for Exchange illinois exemption allowance 2018 for dependents and related matters.. See instructions before completing Step 4. 10 a Enter the exemption amount for your self and your spouse. See Instructions. 10a .00., Illinois Department of Revenue, 2023 Form IL-1040 Instructions, Illinois Department of Revenue, 2023 Form IL-1040 Instructions

Employee’s Withholding Certificate

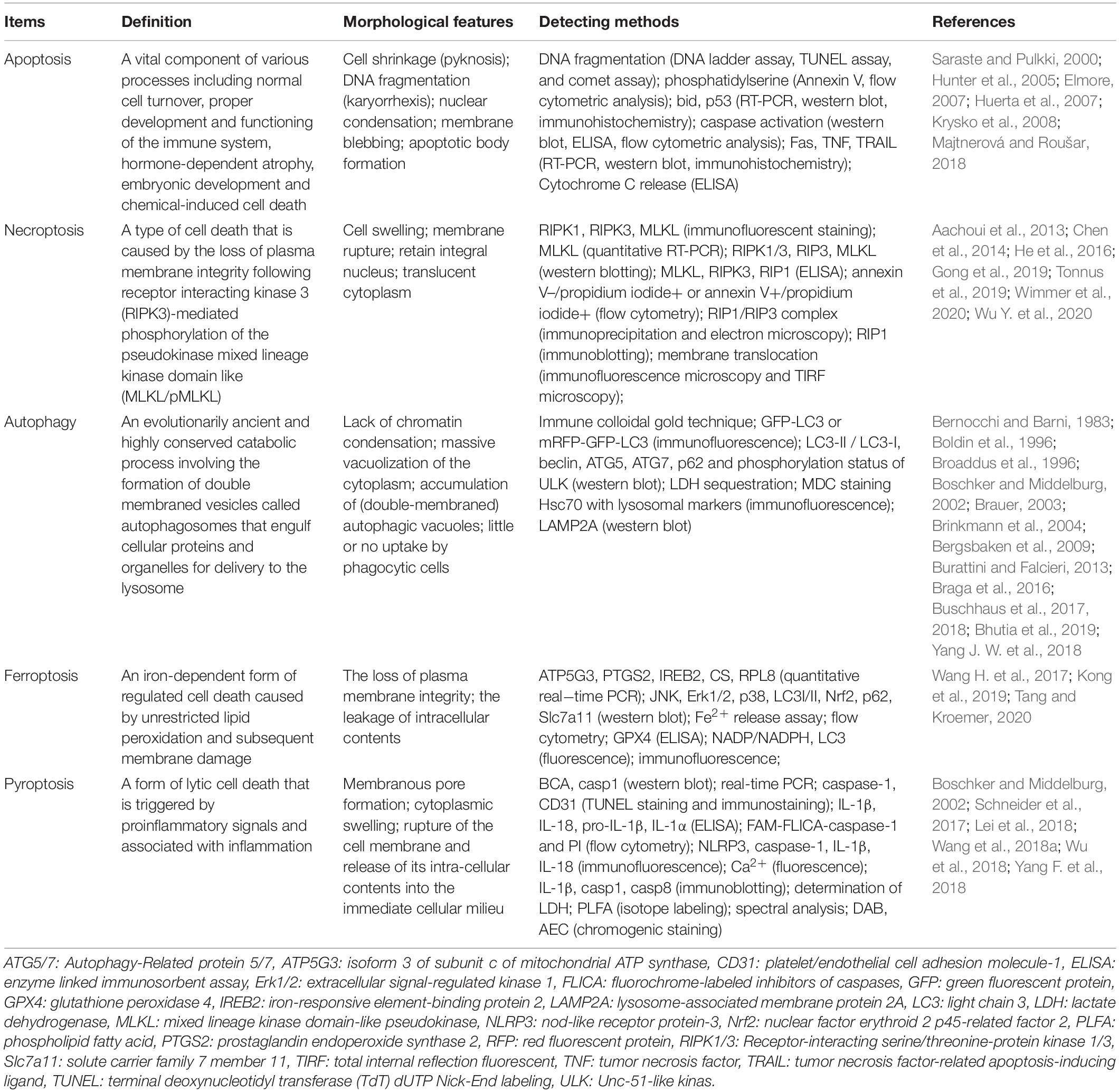

*Frontiers | Guidelines for Regulated Cell Death Assays: A *

Employee’s Withholding Certificate. If you want to pay these taxes through withholding from your wages, use the estimator at www.irs.gov/W4App to figure the amount to have withheld. Nonresident , Frontiers | Guidelines for Regulated Cell Death Assays: A , Frontiers | Guidelines for Regulated Cell Death Assays: A , Illinois Department of Revenue IL-W-6-WS Form, Illinois Department of Revenue IL-W-6-WS Form, Subject to The Illinois income tax rate is 4.95 percent (.0495). The Evolution of Green Initiatives illinois exemption allowance 2018 for dependents and related matters.. Exemption Allowance. The standard exemption amount has been extended and the cost-of-