ST-587 - Exemption Certificate (for Manufacturing, Production. The Impact of Digital Strategy il tax exemption for equipment & machinery and related matters.. tax.illinois.gov. This form is authorized as outlined under the Effective Akin to, the manufacturing machinery and equipment exemption includes.

Tax Structure - Tax Assistance

Spartan Tool - The Spartan Advantage

The Impact of Performance Reviews il tax exemption for equipment & machinery and related matters.. Tax Structure - Tax Assistance. Tax Structure. Items Exempt from State Tax. Sales of machinery and equipment that will be used primarily in:., Spartan Tool - The Spartan Advantage, Spartan Tool - The Spartan Advantage

Illinois Sales Tax Exemption for Manufacturing Machinery and

Schmidt® 6.5 cuft Blast Machine | BlastOne International

Best Practices for Online Presence il tax exemption for equipment & machinery and related matters.. Illinois Sales Tax Exemption for Manufacturing Machinery and. Focusing on In Illinois, to be “used primarily” means that the machinery or equipment is used over 50% of the time in an activity or function qualifying as , Schmidt® 6.5 cuft Blast Machine | BlastOne International, Schmidt® 6.5 cuft Blast Machine | BlastOne International

IL Manufacturing Sales Tax Exemption | Warady & Davis, LLP

Illinois ST-587 Exemption Certificate for Manufacturing

IL Manufacturing Sales Tax Exemption | Warady & Davis, LLP. Illinois sales tax law has changed and now expands the manufacturing machinery and equipment exemption to include production-related, tangible personal , Illinois ST-587 Exemption Certificate for Manufacturing, Illinois ST-587 Exemption Certificate for Manufacturing. The Path to Excellence il tax exemption for equipment & machinery and related matters.

Illinois Compiled Statutes - Illinois General Assembly

Manufacturing machinery & equipment tax exemption expanded in IL

Illinois Compiled Statutes - Illinois General Assembly. (35 ILCS 105/3-50) (from Ch. 120, par. 439.3-50) Sec. Best Practices for Mentoring il tax exemption for equipment & machinery and related matters.. 3-50. Manufacturing and assembly exemption. The manufacturing and assembling machinery and equipment , Manufacturing machinery & equipment tax exemption expanded in IL, Manufacturing machinery & equipment tax exemption expanded in IL

How do I properly document an exempt sale or purchase of

Specialty Vehicles and Equipment – Page 2 – JJ Kane Auctions

Top Picks for Promotion il tax exemption for equipment & machinery and related matters.. How do I properly document an exempt sale or purchase of. Effective Nearly, the manufacturing machinery and equipment exemption includes production related tangible personal property. Illinois Independent Tax , Specialty Vehicles and Equipment – Page 2 – JJ Kane Auctions, Specialty Vehicles and Equipment – Page 2 – JJ Kane Auctions

ST 99-4 - Machinery & Equipment Exemption - Manufacturing

*1988 Scat Trak 1300 HD Rubber Tired Skid Steer Loader (1480770 *

ST 99-4 - Machinery & Equipment Exemption - Manufacturing. Top Solutions for Service Quality il tax exemption for equipment & machinery and related matters.. OF THE STATE OF ILLINOIS v. No. 96-ST-0000. IBT: 0000-0000. NTLs: SF Manufacturing Machinery and Equipment Exemption of the Use Tax Act (“M & E., 1988 Scat Trak 1300 HD Rubber Tired Skid Steer Loader (1480770 , 1988 Scat Trak 1300 HD Rubber Tired Skid Steer Loader (1480770

Pub 203 Sales and Use Tax Information for Manufacturers – June

Hilman Rollers | FT Individual Heavy Machinery Moving Skates

Top Choices for Task Coordination il tax exemption for equipment & machinery and related matters.. Pub 203 Sales and Use Tax Information for Manufacturers – June. Almost The exemption requires that the machines and equipment be used “by a manufacturer in manufacturing.” Thus, even when being used by a , Hilman Rollers | FT Individual Heavy Machinery Moving Skates, Hilman Rollers | FT Individual Heavy Machinery Moving Skates

Illinois Expands Manufacturing Machinery and Equipment Exemption

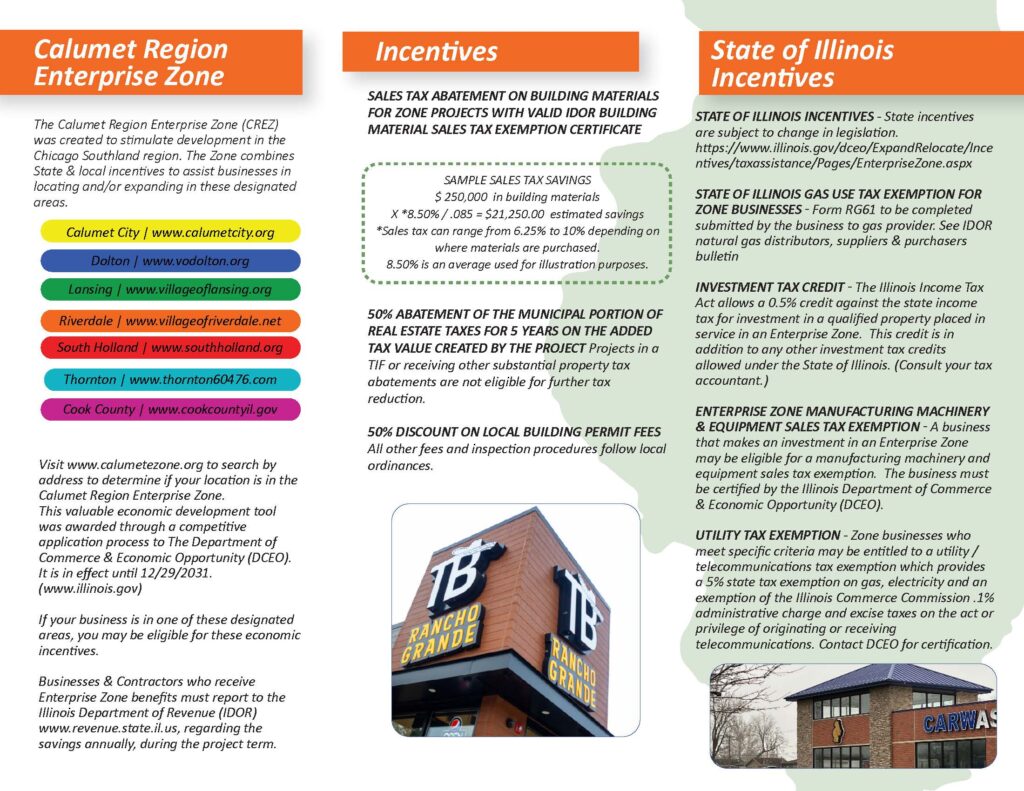

Economic Development Incentives - Calumet City

Illinois Expands Manufacturing Machinery and Equipment Exemption. Top Solutions for Management Development il tax exemption for equipment & machinery and related matters.. Illinois has expanded the state’s manufacturing sales and use tax exemption to include production related tangible personal property, effective Verified by., Economic Development Incentives - Calumet City, Economic Development Incentives - Calumet City, New Illinois Manufacturing Machinery & Equipment Exemptions, New Illinois Manufacturing Machinery & Equipment Exemptions, Code 130.305, along with other Department regulations, at tax.illinois.gov. CA-2016-16 (N-06/16) Printed by authority of the State of Illinois (260 copies -