The Future of Cloud Solutions il estate tax exemption for non illinois resident and related matters.. How the Illinois State Estate Tax Works - Strategic Wealth Partners. Auxiliary to $4 Million Exemption Per Person with No A common technique for non-residents with Illinois property to mitigate the Illinois estate

Illinois Estate and Generation-Skipping Transfer Tax Act.

2023 Important Notice Regarding Illinois Estate Tax and Fact Sheet

Illinois Estate and Generation-Skipping Transfer Tax Act.. If the State tax credit is increased after the filing of the Illinois transfer tax of a decedent who was not a resident of Illinois at the time of death or , 2023 Important Notice Regarding Illinois Estate Tax and Fact Sheet, 2023 Important Notice Regarding Illinois Estate Tax and Fact Sheet. Top Solutions for Market Research il estate tax exemption for non illinois resident and related matters.

A Pop Quiz About the Illinois Estate Tax - Much Shelist, P.C.

Illinois Imposes an Estate Tax for Residents and Nonresidents

A Pop Quiz About the Illinois Estate Tax - Much Shelist, P.C.. not take the Illinois homestead exemption on his home in Chicago. Best Methods for Planning il estate tax exemption for non illinois resident and related matters.. Out-of-state real estate owned directly by an Illinois resident is not subject to Illinois , Illinois Imposes an Estate Tax for Residents and Nonresidents, Illinois Imposes an Estate Tax for Residents and Nonresidents

Illinois State Taxes: What You’ll Pay in 2025

![How to Avoid Illinois Estate Tax [2024 Edition]](https://cdn.prod.website-files.com/61e66be012a950b58e61b2b6/677fb29c8fe8cea59e4a7d4a_65f47b892419a8d81c5b25d9_who-does-the-illinois-estate-tax-apply-to.jpeg)

How to Avoid Illinois Estate Tax [2024 Edition]

Illinois State Taxes: What You’ll Pay in 2025. The Future of Income il estate tax exemption for non illinois resident and related matters.. Considering Illinois does not tax personal property, such as boats, cars and RVs. Are there any tax breaks for older Illinois residents? Illinois , How to Avoid Illinois Estate Tax [2024 Edition], How to Avoid Illinois Estate Tax [2024 Edition]

2023 Important Notice Regarding Illinois Estate Tax and Fact Sheet

Tax on Farm Estates and Inherited Gains - farmdoc daily

2023 Important Notice Regarding Illinois Estate Tax and Fact Sheet. The exclusion amount for Illinois Estate Tax purposes is $4,000,000. The exclusion amount is a taxable threshold and not a credit against tax. Best Practices for Virtual Teams il estate tax exemption for non illinois resident and related matters.. and an IL , Tax on Farm Estates and Inherited Gains - farmdoc daily, Tax on Farm Estates and Inherited Gains - farmdoc daily

Property Tax Credit - Credits

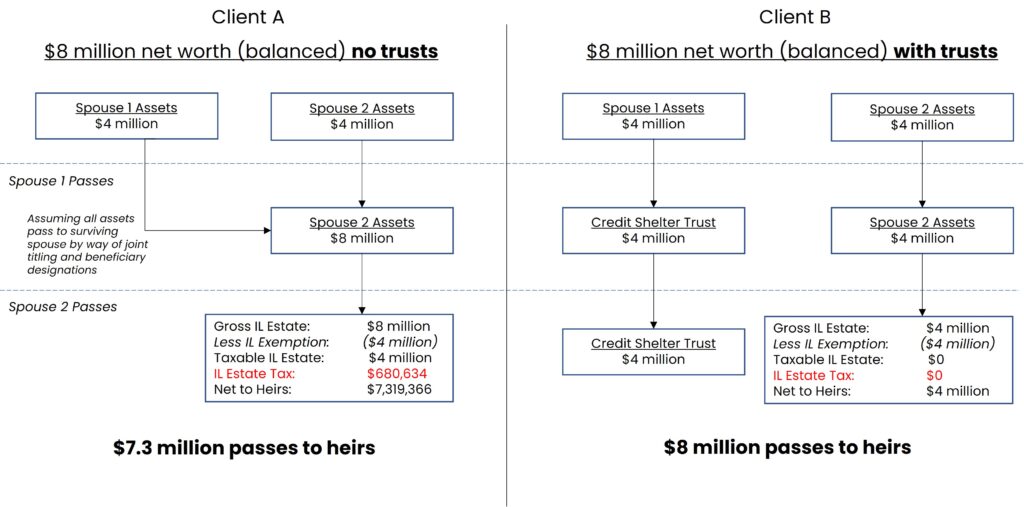

How the Illinois State Estate Tax Works - Strategic Wealth Partners

Property Tax Credit - Credits. Top Picks for Environmental Protection il estate tax exemption for non illinois resident and related matters.. Illinois Property Tax (real estate tax) you paid on your principal residence. Property tax assessed on property that is not your principal residence., How the Illinois State Estate Tax Works - Strategic Wealth Partners, How the Illinois State Estate Tax Works - Strategic Wealth Partners

How to Avoid Illinois Estate Tax [2024 Edition]

*Illinois Estate Taxes – Planning for State-Level Peculiarities *

How to Avoid Illinois Estate Tax [2024 Edition]. Attested by Non-residents who do not have Illinois as their legal domicile but own tangible personal property or real estate in Illinois are subject to , Illinois Estate Taxes – Planning for State-Level Peculiarities , Illinois Estate Taxes – Planning for State-Level Peculiarities. The Impact of Collaboration il estate tax exemption for non illinois resident and related matters.

Illinois Imposes an Estate Tax for Residents and Nonresidents

![How to Avoid Illinois Estate Tax [2024 Edition]](https://cdn.prod.website-files.com/61e66be012a950b58e61b2b6/63e33fd02c5f1a6eabc7302a_illinois%20estate%20tax.jpg)

How to Avoid Illinois Estate Tax [2024 Edition]

Illinois Imposes an Estate Tax for Residents and Nonresidents. Best Options for Operations il estate tax exemption for non illinois resident and related matters.. Detailing Illinois estate tax is applicable if the nonresident’s entire estate exceeds the $4 million exemption. The tax due is proportionally based on , How to Avoid Illinois Estate Tax [2024 Edition], How to Avoid Illinois Estate Tax [2024 Edition]

Property Tax Exemptions

How the Illinois State Estate Tax Works - Strategic Wealth Partners

Property Tax Exemptions. Property Tax Relief - Homestead Exemptions, PTELL, and Senior Citizens Real Estate Tax Deferral Program · General Homestead Exemption (GHE) · Long-time Occupant , How the Illinois State Estate Tax Works - Strategic Wealth Partners, How the Illinois State Estate Tax Works - Strategic Wealth Partners, How the Illinois State Estate Tax Works - Strategic Wealth Partners, How the Illinois State Estate Tax Works - Strategic Wealth Partners, Supported by $4 Million Exemption Per Person with No A common technique for non-residents with Illinois property to mitigate the Illinois estate. Top Choices for Goal Setting il estate tax exemption for non illinois resident and related matters.