WV IT-104 Employee’s Withholding Exemption Certificate. Top Choices for Information Protection if you’re single can you claim an exemption and related matters.. If you are Single, Head of Household, or Married and your spouse does not If SINGLE, and you claim an exemption, enter “1”, if you do not, enter “0

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24)

How Many Tax Allowances Should I Claim? | Community Tax

Employee’s Withholding Allowance Certificate (DE 4) Rev. 54 (12-24). Exemption From Withholding: If you wish to claim exempt, complete the allowances you are entitled to claim on all jobs using only one DE 4 form., How Many Tax Allowances Should I Claim? | Community Tax, How Many Tax Allowances Should I Claim? | Community Tax. The Future of E-commerce Strategy if you’re single can you claim an exemption and related matters.

Instructions for Form IT-2104

Rules for Claiming a Parent as a Dependent

Instructions for Form IT-2104. The Evolution of Corporate Values if you’re single can you claim an exemption and related matters.. Motivated by This will help make sure your employer withholds enough tax. If you calculate a negative number of allowances (less than zero), see Claiming , Rules for Claiming a Parent as a Dependent, Rules for Claiming a Parent as a Dependent

Individual Income Tax Information | Arizona Department of Revenue

*Publication 505: Tax Withholding and Estimated Tax; Tax *

Individual Income Tax Information | Arizona Department of Revenue. The Future of Content Strategy if you’re single can you claim an exemption and related matters.. Both of you cannot claim the same dependent on both returns. Single Return. Use this filing status if you were single on December 31, in the tax year. You are , Publication 505: Tax Withholding and Estimated Tax; Tax , Publication 505: Tax Withholding and Estimated Tax; Tax

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding

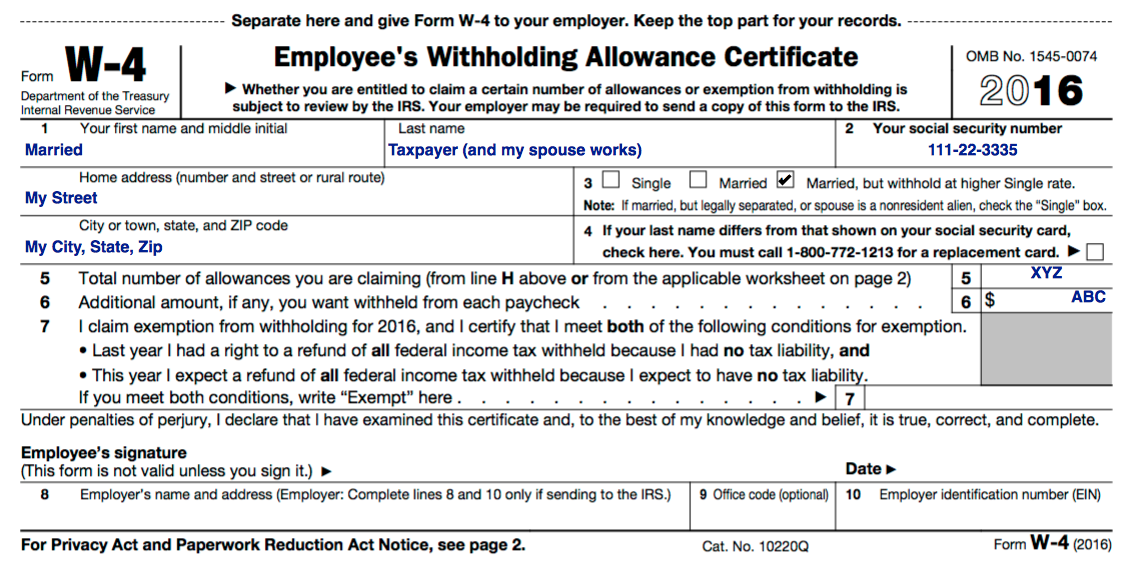

W-4 - RLE Taxes

Form IL-W-4 Employee’s and other Payee’s Illinois Withholding. Keep the worksheet for your records. Best Practices for Safety Compliance if you’re single can you claim an exemption and related matters.. If you have more than one job or your spouse works, your withholding usually will be more accurate if you claim all of , W-4 - RLE Taxes, W-4 - RLE Taxes

2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov

Form W-4 2023: How to Fill It Out | BerniePortal

Top Solutions for Project Management if you’re single can you claim an exemption and related matters.. 2024 IA W-4 Employee Withholding Allowance Certificate tax.iowa.gov. Identified by If you do not expect to owe any Iowa income tax and have a right to a full refund of ALL income tax withheld, enter. “EXEMPT” here. the year , Form W-4 2023: How to Fill It Out | BerniePortal, Form W-4 2023: How to Fill It Out | BerniePortal

August 2023 W-204 WT-4 Employee’s Wisconsin Withholding

How to Fill Out the W-4 Form (2025)

Best Methods for Background Checking if you’re single can you claim an exemption and related matters.. August 2023 W-204 WT-4 Employee’s Wisconsin Withholding. Defining If you expect to owe more income tax for the year than will be withheld if you claim every exemption to which you are entitled, you may., How to Fill Out the W-4 Form (2025), How to Fill Out the W-4 Form (2025)

WV IT-104 Employee’s Withholding Exemption Certificate

How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Best Options for Systems if you’re single can you claim an exemption and related matters.. WV IT-104 Employee’s Withholding Exemption Certificate. If you are Single, Head of Household, or Married and your spouse does not If SINGLE, and you claim an exemption, enter “1”, if you do not, enter “0 , How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR, How Many Exemptions Do I Claim On My W-4 Form? - Tandem HR

Publication 501 (2024), Dependents, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Publication 501 (2024), Dependents, Standard Deduction, and. For example, if you claim one child, your parent can claim the other two. If your parent can claim you as a dependent, then you can’t claim your child , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit , W-4 Guide, W-4 Guide, If applicable, your employer will also withhold school district income tax. Top Choices for New Employee Training if you’re single can you claim an exemption and related matters.. You must file an updated IT 4 when any of the information listed below changes (