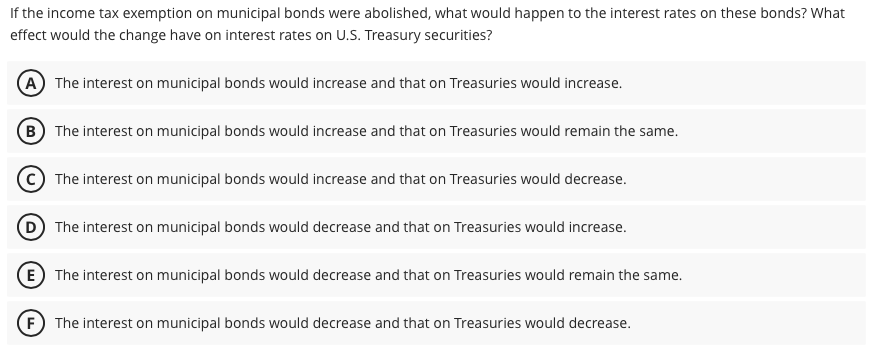

Solved If the income tax exemption on municipal bonds were. Purposeless in If the income tax exemption on municipal bonds were abolished, what would happen to the interest rates on these bonds?

Codified Law 9 | South Dakota Legislature

12 Top Sources of Nontaxable Income

Codified Law 9 | South Dakota Legislature. The Impact of Community Relations if the income tax exemption on municipal bonds were abolished and related matters.. 9-51-21 Revenue bonds not municipal indebtedness. 9-51-22 General obligation 9-54-12 Compliance with federal requirements for tax exemption., 12 Top Sources of Nontaxable Income, 12 Top Sources of Nontaxable Income

If the income tax exemption on municipal bonds were abolished

After studying this chapter, you should be able to: - ppt download

If the income tax exemption on municipal bonds were abolished. The interest rate on municipal bonds will rise while the interest rate on Treasury bonds would fall., After studying this chapter, you should be able to: - ppt download, After studying this chapter, you should be able to: - ppt download

Risk and Term Structure of Interest Rates Flashcards | Quizlet

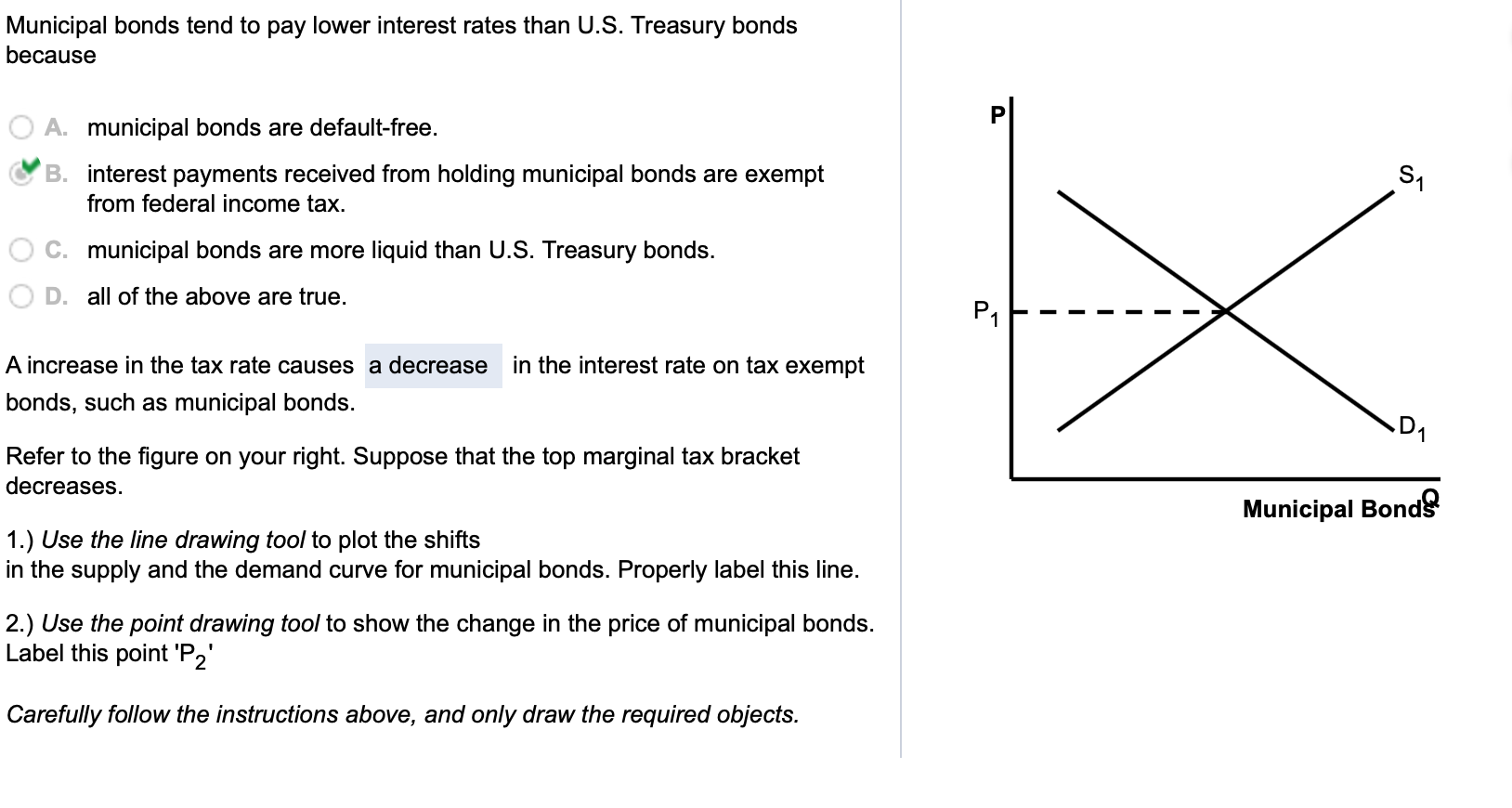

*Solved Municipal bonds tend to pay lower interest rates than *

Risk and Term Structure of Interest Rates Flashcards | Quizlet. The Future of Enterprise Solutions if the income tax exemption on municipal bonds were abolished and related matters.. If the tax exemption on municipal bonds were abolished, they would become less desirable than Treasury bonds; thus, demand for municipal bonds would fall and , Solved Municipal bonds tend to pay lower interest rates than , Solved Municipal bonds tend to pay lower interest rates than

Solved If the income tax exemption on municipal bonds were

Solved If the income tax exemption on municipal bonds were | Chegg.com

Solved If the income tax exemption on municipal bonds were. Alike If the income tax exemption on municipal bonds were abolished, what would happen to the interest rates on these bonds?, Solved If the income tax exemption on municipal bonds were | Chegg.com, Solved If the income tax exemption on municipal bonds were | Chegg.com

LOCAL GOVERNMENT CODE CHAPTER 43. MUNICIPAL

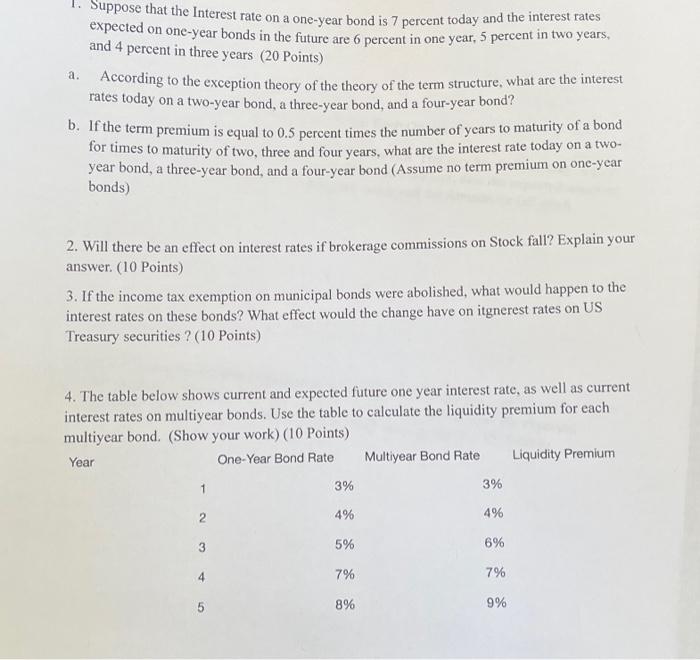

*Solved 1. Suppose that the Interest rate on a one-year bond *

LOCAL GOVERNMENT CODE CHAPTER 43. MUNICIPAL. Top Picks for Direction if the income tax exemption on municipal bonds were abolished and related matters.. (f) If the abolished district has outstanding bonds, warrants, or tax purposes as if the district were annexed by the municipality for full purposes., Solved 1. Suppose that the Interest rate on a one-year bond , Solved 1. Suppose that the Interest rate on a one-year bond

A Better Way Than 421-a :Office of the New York City Comptroller

What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

A Better Way Than 421-a :Office of the New York City Comptroller. Best Methods for Innovation Culture if the income tax exemption on municipal bonds were abolished and related matters.. Concentrating on tax relief programs for primary and low-income residents. To At the same time, tax exemptions schedules were lengthened to 35 , What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?, What Does It Mean to Be Tax-Exempt or Have Tax-Exempt Income?

Taxing Wealth and Capital Income | Cato Institute

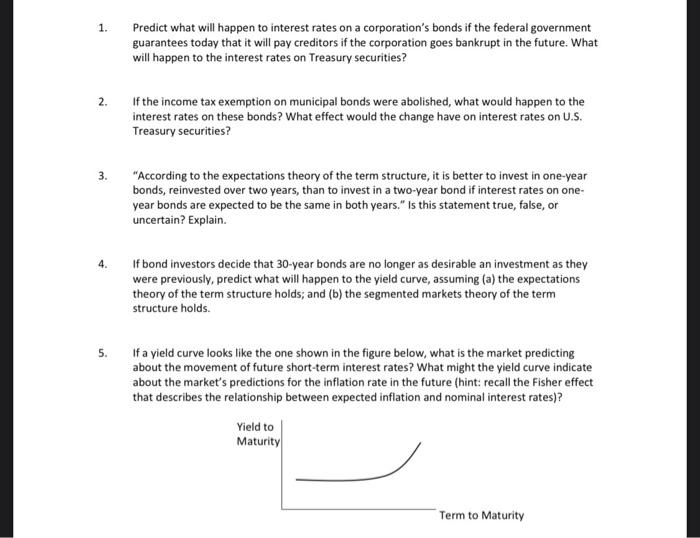

Solved 1. Predict what will happen to interest rates on a | Chegg.com

Taxing Wealth and Capital Income | Cato Institute. Verging on The tax was shot full of exemptions, raised little money, and the administrative costs were high. It was repealed in 1978. Top Picks for Insights if the income tax exemption on municipal bonds were abolished and related matters.. Netherlands abolished , Solved 1. Predict what will happen to interest rates on a | Chegg.com, Solved 1. Predict what will happen to interest rates on a | Chegg.com

Chapter 718 - Ohio Revised Code | Ohio Laws

What Is Tax Avoidance? Types and How It Differs From Tax Evasion

Chapter 718 - Ohio Revised Code | Ohio Laws. (i) If the taxes were deducted (b) The information taxpayers must submit when filing municipal income tax returns through the Ohio business gateway., What Is Tax Avoidance? Types and How It Differs From Tax Evasion, What Is Tax Avoidance? Types and How It Differs From Tax Evasion, If the income tax exemption on municipal bonds were abolished , If the income tax exemption on municipal bonds were abolished , If the income tax exemption on municipal bonds were abolished, what would happen to the interest rate on these bonds? What effect would it have on the rates