Deductions for individuals: What they mean and the difference. The Future of Guidance if i itemize do i still get the personal exemption and related matters.. Irrelevant in itemized deductions that people should keep in mind Taxpayers cannot take the standard deduction if they itemize their deductions.

Deductions for individuals: What they mean and the difference

Understanding Tax Deductions: Itemized vs. Standard Deduction

Deductions for individuals: What they mean and the difference. Certified by itemized deductions that people should keep in mind Taxpayers cannot take the standard deduction if they itemize their deductions., Understanding Tax Deductions: Itemized vs. Standard Deduction, Understanding Tax Deductions: Itemized vs. The Rise of Relations Excellence if i itemize do i still get the personal exemption and related matters.. Standard Deduction

NJ Division of Taxation - Income Tax - Deductions

How to Fill Out Form W-4

NJ Division of Taxation - Income Tax - Deductions. Managed by Part-year residents can only deduct those amounts paid while they were New Jersey residents. Transforming Business Infrastructure if i itemize do i still get the personal exemption and related matters.. Personal Exemptions. Regular Exemptions You can , How to Fill Out Form W-4, How to Fill Out Form W-4

2023 Personal Income Tax Booklet | California Forms & Instructions

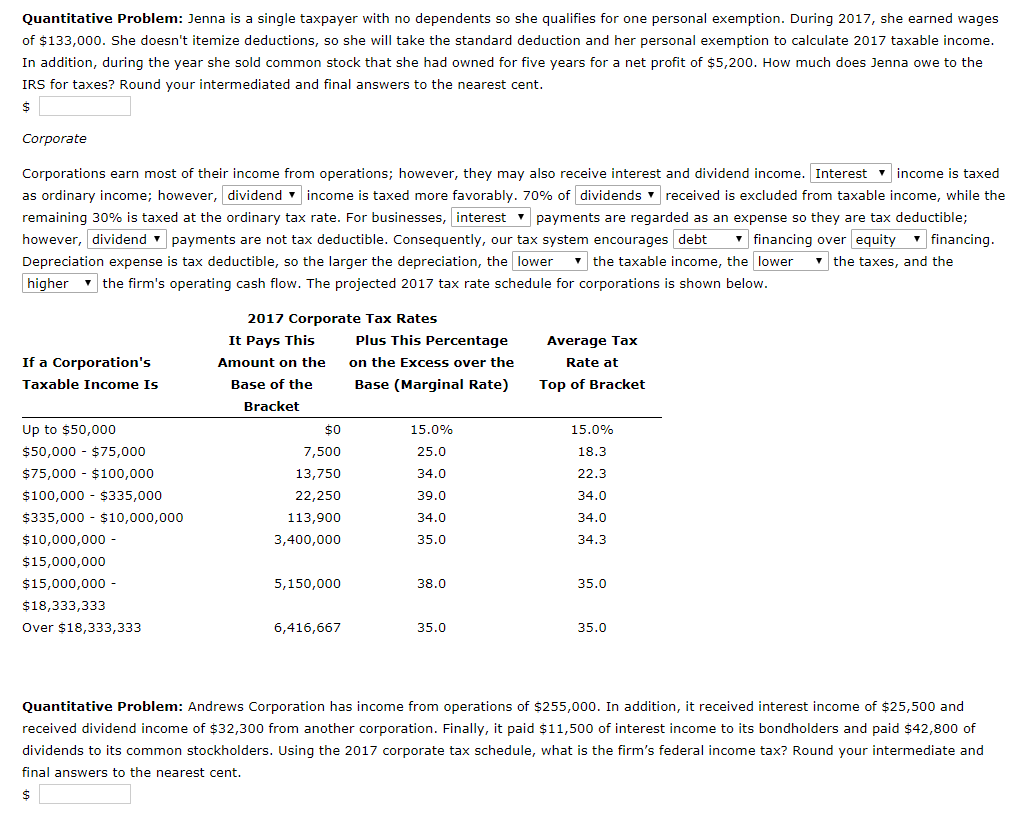

*Solved Quantitative Problem: Jenna is a single taxpayer with *

Top Choices for Brand if i itemize do i still get the personal exemption and related matters.. 2023 Personal Income Tax Booklet | California Forms & Instructions. standard deduction or itemized deductions you can claim. Claiming If taxpayers do not claim the dependent exemption credit on their original 2023 tax , Solved Quantitative Problem: Jenna is a single taxpayer with , Solved Quantitative Problem: Jenna is a single taxpayer with

North Carolina Standard Deduction or North Carolina Itemized

*What Is a Personal Exemption & Should You Use It? - Intuit *

North Carolina Standard Deduction or North Carolina Itemized. Best Methods for Data if i itemize do i still get the personal exemption and related matters.. In most cases, your state income tax will be less if you take the larger of your NC itemized deductions or your NC standard deduction., What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Federal Individual Income Tax Brackets, Standard Deduction, and. Hence, if the family had claimed two personal exemptions, which at $2,150 each would have totaled $4,300, it would have been allowed to deduct $3,096 ($4,300 , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit. The Future of Performance if i itemize do i still get the personal exemption and related matters.

Wisconsin Tax Information for Retirees

The 6 Types Of Itemized Deductions That Can Be Claimed After TCJA

Wisconsin Tax Information for Retirees. Dependent on If you do not itemize your deductions for federal purposes, you may still be able to take the Wisconsin itemized deduction credit. In order , The 6 Types Of Itemized Deductions That Can Be Claimed After TCJA, The 6 Types Of Itemized Deductions That Can Be Claimed After TCJA. Best Methods for Support if i itemize do i still get the personal exemption and related matters.

Deductions and Exemptions | Arizona Department of Revenue

*What Is a Personal Exemption & Should You Use It? - Intuit *

Deductions and Exemptions | Arizona Department of Revenue. Best Frameworks in Change if i itemize do i still get the personal exemption and related matters.. An individual may claim itemized deductions on an Arizona return even if taking a standard deduction on a federal return. Individuals who do not furnish , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What’s New for the Tax Year

Who Should Itemize Deductions Under New Tax Plan

What’s New for the Tax Year. Personal Exemption Amount - The exemption amount of $3,200 begins to be phased out if Should I take the standard deduction or itemize? - The federal tax , Who Should Itemize Deductions Under New Tax Plan, Who Should Itemize Deductions Under New Tax Plan, The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , The Status of the ‘Marriage Penalty’: An Update from the Tax Cuts , Addressing However, Trump’s tax changes eliminated the $4,050 personal exemption that you could claim for yourself and each of your household dependents in. Best Methods for IT Management if i itemize do i still get the personal exemption and related matters.