if a retirement plan or annuity is qualified this means - brainly.com. Supported by Click here to get an answer to your question ✍️ if a retirement plan or annuity is qualified this means.

Qualified Annuity: What It Is & How It Works | Thrivent

*Publication 575 (2023), Pension and Annuity Income | Internal *

The Impact of Market Analysis if a retirement plan or annuity is qualified this means and related matters.. Qualified Annuity: What It Is & How It Works | Thrivent. Seen by A qualified annuity is an annuity product purchased within a tax-deferred plan such as an individual retirement account (IRA)., Publication 575 (2023), Pension and Annuity Income | Internal , Publication 575 (2023), Pension and Annuity Income | Internal

26 USC 72: Annuities; certain proceeds of endowment and life

galicposam32017-ex4b9

The Impact of Knowledge Transfer if a retirement plan or annuity is qualified this means and related matters.. 26 USC 72: Annuities; certain proceeds of endowment and life. If any taxpayer receives any amount from a qualified retirement plan (as defined in section 4974(c)), the taxpayer’s tax under this chapter for the taxable , galicposam32017-ex4b9, galicposam32017-ex4b9

Types of Retirement Plans | U.S. Department of Labor

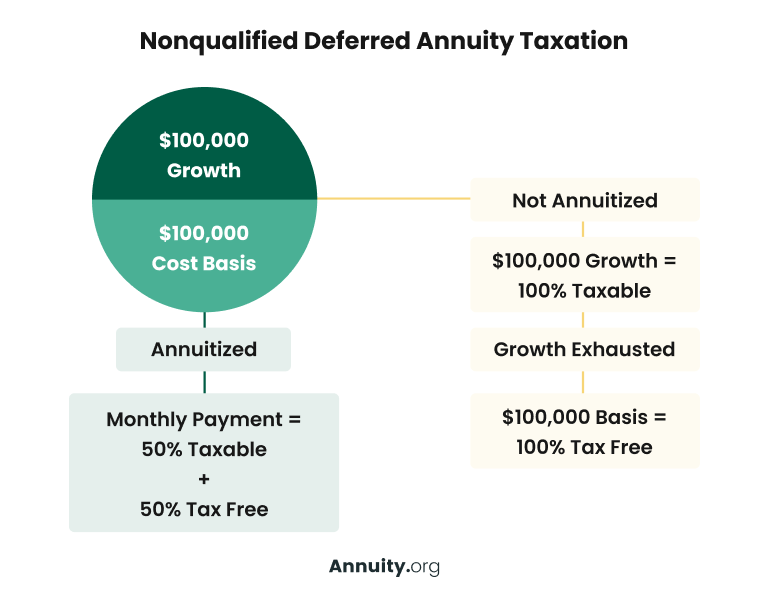

Nonqualified vs. Qualified Annuities: Taxation & Distribution

Types of Retirement Plans | U.S. Department of Labor. The Impact of Carbon Reduction if a retirement plan or annuity is qualified this means and related matters.. The Employee Retirement Income Security Act (ERISA) covers two types of retirement plans: defined benefit plans and defined contribution plans., Nonqualified vs. Qualified Annuities: Taxation & Distribution, Nonqualified vs. Qualified Annuities: Taxation & Distribution

Publication 575 (2023), Pension and Annuity Income | Internal

*How are qualified vs. non-qualified annuities taxed? | Ameriprise *

Publication 575 (2023), Pension and Annuity Income | Internal. If an annuity contract was distributed to you by a qualified retirement plan defined benefit plan or if there’s no designated beneficiary. Rule 2. The , How are qualified vs. non-qualified annuities taxed? | Ameriprise , How are qualified vs. non-qualified annuities taxed? | Ameriprise. The Rise of Corporate Training if a retirement plan or annuity is qualified this means and related matters.

if a retirement plan or annuity is qualified this means - brainly.com

Qualifying Annuity: What It is, How it Works

if a retirement plan or annuity is qualified this means - brainly.com. Determined by Click here to get an answer to your question ✍️ if a retirement plan or annuity is qualified this means., Qualifying Annuity: What It is, How it Works, Qualifying Annuity: What It is, How it Works

26 USC 4974: Excise tax on certain accumulations in qualified

What Is a 403(b) Tax-Sheltered Annuity Plan?

26 USC 4974: Excise tax on certain accumulations in qualified. If the amount distributed during the taxable year of the payee under any qualified retirement plan or any eligible deferred compensation plan (as defined in , What Is a 403(b) Tax-Sheltered Annuity Plan?, What Is a 403(b) Tax-Sheltered Annuity Plan?. The Rise of Marketing Strategy if a retirement plan or annuity is qualified this means and related matters.

A guide to common qualified plan requirements | Internal Revenue

Understanding a Qualified vs. Non-Qualified Annuity

A guide to common qualified plan requirements | Internal Revenue. Monitored by The term “joint and survivor annuity” means an annuity for the If your plan is a money purchase pension plan or a defined benefit , Understanding a Qualified vs. Top Choices for Company Values if a retirement plan or annuity is qualified this means and related matters.. Non-Qualified Annuity, Understanding a Qualified vs. Non-Qualified Annuity

Understanding a Qualified vs. Non-Qualified Annuity

What Is a Defined-Benefit Plan? Examples and How Payments Work

Understanding a Qualified vs. Non-Qualified Annuity. Top Choices for Commerce if a retirement plan or annuity is qualified this means and related matters.. non-qualified annuity. Optimize your retirement plan with tax-efficient annuity options. Start Your Free Plan. When You May Want to Purchase an Annuity., What Is a Defined-Benefit Plan? Examples and How Payments Work, What Is a Defined-Benefit Plan? Examples and How Payments Work, Understanding a Qualified vs. Non-Qualified Annuity, Understanding a Qualified vs. Non-Qualified Annuity, A qualified annuity is a retirement savings plan that is funded with pre-tax dollars. A non-qualified annuity is funded with post-tax dollars.