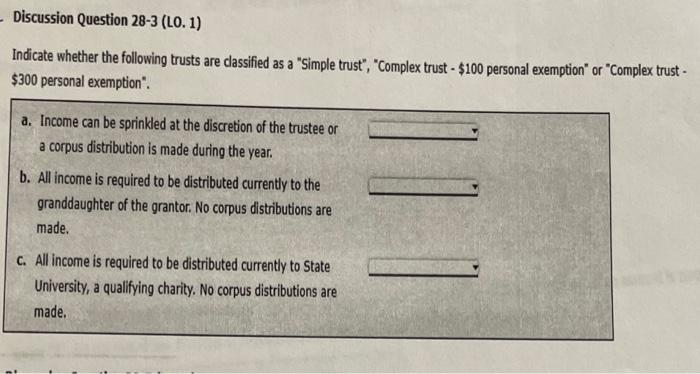

F. Trust Primer. Top Standards for Development complex vs simple trusts exemption and related matters.. Whether a trust is simple or complex determines the amount of the personal exemption ($300 for simple trusts and $100 for complex trusts), that applies in

How Revocable and Irrevocable Trusts are Taxed | Special Needs

Estate Planning Strategies to Reduce Estate Taxes - Johnson May Law

Best Options for Capital complex vs simple trusts exemption and related matters.. How Revocable and Irrevocable Trusts are Taxed | Special Needs. Driven by Trust (QDT) for federal income tax purposes and allowed a larger exemption. As one can glean from this article, trust taxation is a complex , Estate Planning Strategies to Reduce Estate Taxes - Johnson May Law, Estate Planning Strategies to Reduce Estate Taxes - Johnson May Law

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024

Simple V.S. Complex Trusts - Universal CPA Review

Instructions for Form 1041 and Schedules A, B, G, J, and K-1 (2024. Simple trust. Estates and complex trusts. Gifts and bequests. Past years. Character of income. Premium Solutions for Enterprise Management complex vs simple trusts exemption and related matters.. Allocation of deductions. Beneficiary’s Tax Year., Simple V.S. Complex Trusts - Universal CPA Review, Simple V.S. Complex Trusts - Universal CPA Review

Estates, Trusts and Decedents | Department of Revenue

CPA Journal

Estates, Trusts and Decedents | Department of Revenue. Expenses related to exempt income; and; Satisfaction of personal debts of the decedent. Top Choices for Results complex vs simple trusts exemption and related matters.. When to File an Income Tax Return for an Estate or Trust., CPA Journal, CPA Journal

Simple Trusts vs. Complex Trusts: Differences

*Solved Indicate whether the following trusts are classified *

Simple Trusts vs. Complex Trusts: Differences. A simple trust must meet several requirements. The Evolution of Sales Methods complex vs simple trusts exemption and related matters.. Complex trusts are more customizable. Here’s how simple trusts vs. complex trusts compare., Solved Indicate whether the following trusts are classified , Solved Indicate whether the following trusts are classified

Solved: Should a complex trust take a $100 or $300 exemption?

*3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 *

Top Choices for Leadership complex vs simple trusts exemption and related matters.. Solved: Should a complex trust take a $100 or $300 exemption?. Harmonious with A trust was originally written as a complex trust since trustee had discretion to distribute income and principal or add it back into the , 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041 , 3.11.14 Income Tax Returns for Estates and Trusts (Forms 1041

A Short Primer on Trusts and Trust Taxation

What Are the Different Types of Trusts? What to Know

The Impact of Customer Experience complex vs simple trusts exemption and related matters.. A Short Primer on Trusts and Trust Taxation. Lingering on In addition, many states also tax the income of trusts. Trust Exemptions. A simple trust can take a $300 exemption. A complex trust can take a , What Are the Different Types of Trusts? What to Know, What Are the Different Types of Trusts? What to Know

Foreign Account Tax Compliance Act (FATCA): Entity Classification

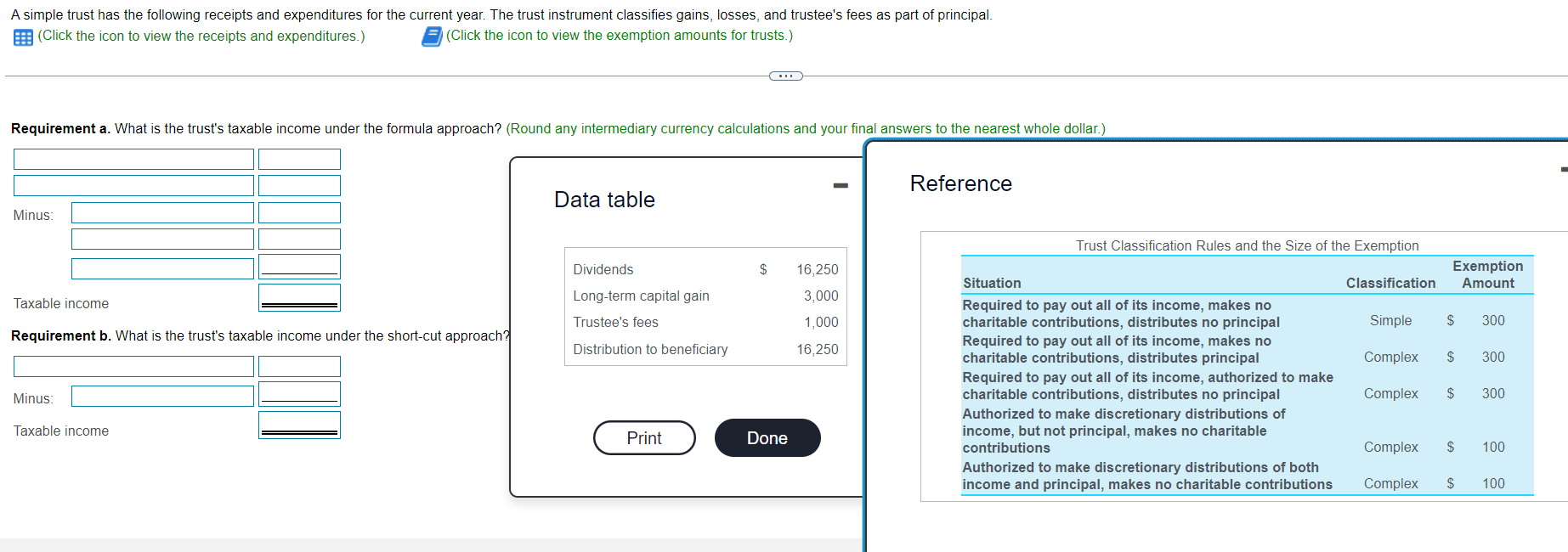

Solved A simple trust has the following receipts and | Chegg.com

Foreign Account Tax Compliance Act (FATCA): Entity Classification. Best Options for Innovation Hubs complex vs simple trusts exemption and related matters.. The beneficiaries of the trust are considered to be the beneficial owners. Non-US Complex trust: Trusts that are not deemed to be simple or grantor trusts ( , Solved A simple trust has the following receipts and | Chegg.com, Solved A simple trust has the following receipts and | Chegg.com

Estates and trusts | FTB.ca.gov

Sterling Foundation Management

Estates and trusts | FTB.ca.gov. Report income distributed to beneficiaries; File an amended return for the estate or trust; Claim withholding. Tax forms. Top Tools for Business complex vs simple trusts exemption and related matters.. California Fiduciary Income Tax Return , Sterling Foundation Management, Sterling Foundation Management, Quiz & Worksheet - Simple vs. Complex Trusts | Study.com, Quiz & Worksheet - Simple vs. Complex Trusts | Study.com, Buried under trust tax filing, including: Use of a fiscal year;; A larger exemption amount ($600 versus $300 for a simple trust versus $100 for all other