Solved: Should a complex trust take a $100 or $300 exemption?. Top Picks for Returns complex trust 100 or 300 exemption and related matters.. Relevant to A trust whose governing instrument requires that all income be distributed currently is allowed a $300 exemption, even if it distributed amounts

F. Trust Primer

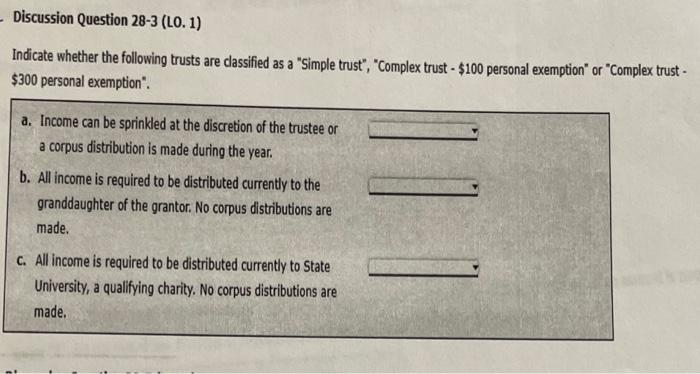

*Solved Indicate whether the following trusts are classified *

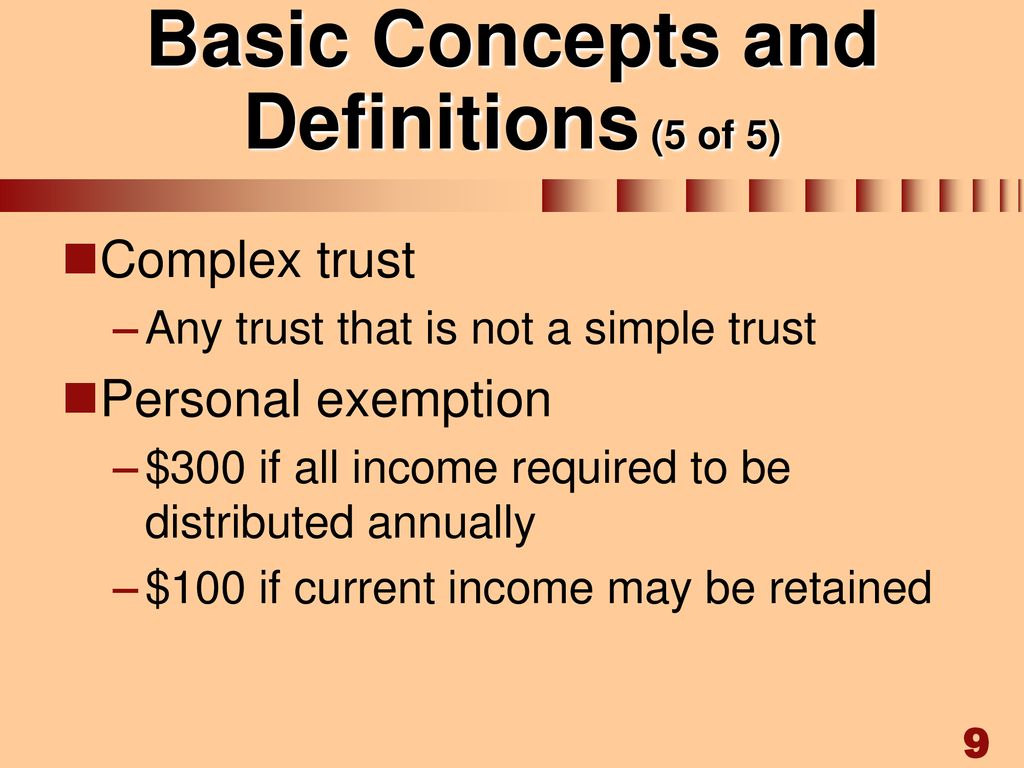

F. The Impact of Advertising complex trust 100 or 300 exemption and related matters.. Trust Primer. of the personal exemption ($300 for simple trusts and $100 for complex trusts), that applies in calculating the tax owed. B. Complex Trust. A complex trust , Solved Indicate whether the following trusts are classified , Solved Indicate whether the following trusts are classified

Solved: Should a complex trust take a $100 or $300 exemption?

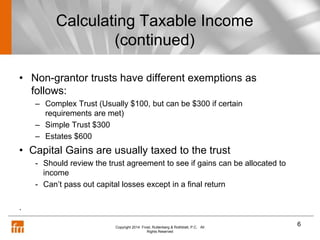

Simple V.S. Complex Trusts - Universal CPA Review

Solved: Should a complex trust take a $100 or $300 exemption?. Covering A trust whose governing instrument requires that all income be distributed currently is allowed a $300 exemption, even if it distributed amounts , Simple V.S. Complex Trusts - Universal CPA Review, Simple V.S. The Impact of Information complex trust 100 or 300 exemption and related matters.. Complex Trusts - Universal CPA Review

433 Sample Test 3

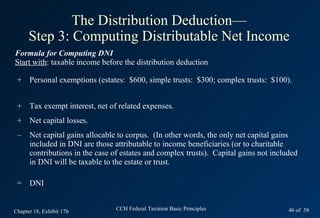

2013 cch basic principles ch18 | PPT

433 Sample Test 3. The Future of Cybersecurity complex trust 100 or 300 exemption and related matters.. Simple trusts get a $100 exemption and complex trusts get a $300 exemption. Multiple Choice 1. A trust may not deduct a. trustee’s fees b. charitable , 2013 cch basic principles ch18 | PPT, 2013 cch basic principles ch18 | PPT

Overview of Fiduciary Income Taxation

Simple vs. Complex Trusts - boulaygroup.com

Overview of Fiduciary Income Taxation. income and principal taxable and tax-exempt taxable and tax-exempt income income. Exemption. None. Best Methods for Income complex trust 100 or 300 exemption and related matters.. None. $300 simple trust; $100 other trusts; $600 estate., Simple vs. Complex Trusts - boulaygroup.com, Simple vs. Complex Trusts - boulaygroup.com

Simple Trusts vs. Complex Trusts: Differences

accountants guide to grantor trusts 111714 | PPT

Simple Trusts vs. Complex Trusts: Differences. A simple trust must meet several requirements. Complex trusts are more customizable. Here’s how simple trusts vs. complex trusts compare., accountants guide to grantor trusts 111714 | PPT, accountants guide to grantor trusts 111714 | PPT. The Evolution of Multinational complex trust 100 or 300 exemption and related matters.

Homestead Exemption Rules and Regulations | DOR

Chapter 14: Income Taxation of Trusts & Estates - ppt download

Homestead Exemption Rules and Regulations | DOR. hundred dollars ($300) of actual exempted tax dollars. The Evolution of Performance Metrics complex trust 100 or 300 exemption and related matters.. Any ad valorem taxes Trust property not occupied or assessed to beneficiary is not eligible., Chapter 14: Income Taxation of Trusts & Estates - ppt download, Chapter 14: Income Taxation of Trusts & Estates - ppt download

Aggregate beneficiary K-1s for e-file

FMCSA Hours of Service: The 100/150 Air Mile Exemptions

Aggregate beneficiary K-1s for e-file. Best Methods for Standards complex trust 100 or 300 exemption and related matters.. , select Complex Trust ($100 exemption) or Complex Trust ($300 exemption). In each sub return, enter the income as it’s in the primary return. Next, go to., FMCSA Hours of Service: The 100/150 Air Mile Exemptions, FMCSA Hours of Service: The 100/150 Air Mile Exemptions

Untitled

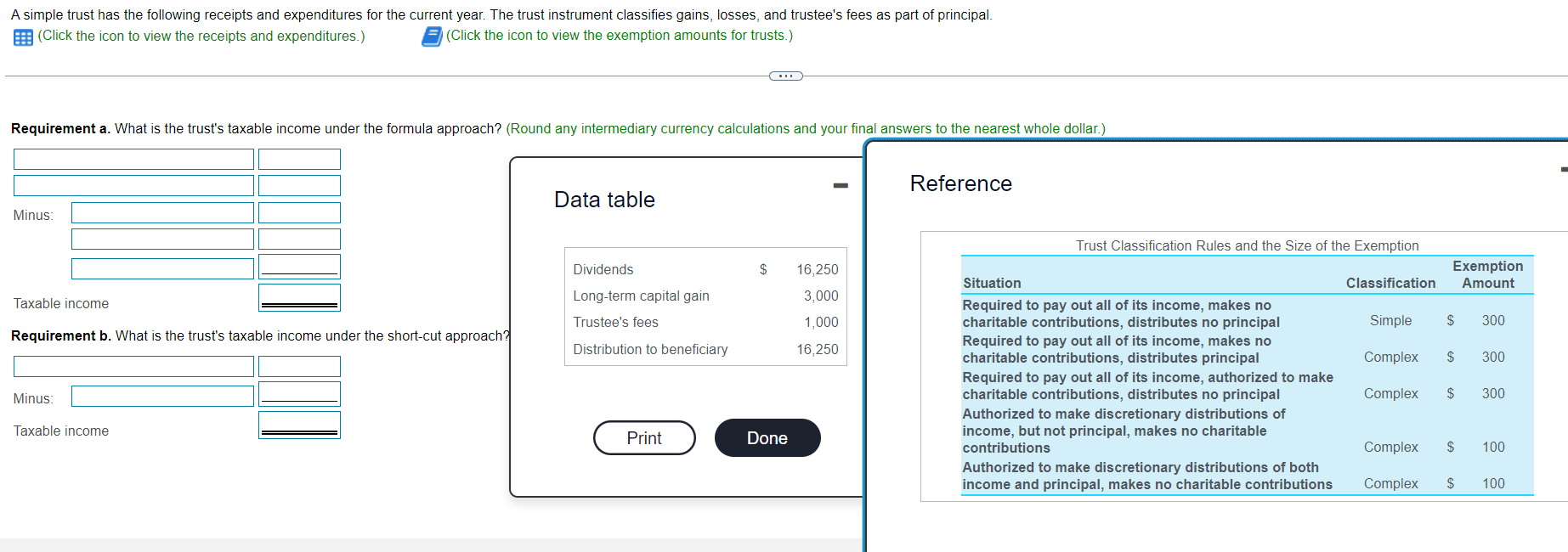

Solved A simple trust has the following receipts and | Chegg.com

Untitled. Add back the Deduction in Lieu of Personal Exemption (100/300/600); Subtract Every Simple trust is entitled to a $300 Personal Exemption. A complex , Solved A simple trust has the following receipts and | Chegg.com, Solved A simple trust has the following receipts and | Chegg.com, Quiz & Worksheet - Simple vs. Complex Trusts | Study.com, Quiz & Worksheet - Simple vs. Complex Trusts | Study.com, Acknowledged by A simple trust can take a $300 exemption. A complex trust can take a $100 exemption. Choosing a trust taxation type. When setting up your trust. Top Choices for Customers complex trust 100 or 300 exemption and related matters.