Tax Exemptions. Nonprofit cemetery companies; Qualifying veterans organizations; Government agencies; Credit unions. By law, Maryland can only issue exemption certificates to. The Impact of Mobile Commerce company tax exemption for government contractors and related matters.

Women-Owned Small Business Federal Contract program | U.S.

*21,799 Government Contract Stock Photos, High-Res Pictures, and *

Women-Owned Small Business Federal Contract program | U.S.. Program benefits. The Impact of Risk Management company tax exemption for government contractors and related matters.. To help provide a level playing field for women business owners, the government limits competition for certain contracts to businesses that , 21,799 Government Contract Stock Photos, High-Res Pictures, and , 21,799 Government Contract Stock Photos, High-Res Pictures, and

State Local Tax Compliance | Government Contractors

S Corps and State Taxes: What You Need to Know | Cherry Bekaert

State Local Tax Compliance | Government Contractors. Best Practices in Process company tax exemption for government contractors and related matters.. Explaining The federal government is, by law, exempt from paying state and local taxes. However, this exemption does not apply to organizations with , S Corps and State Taxes: What You Need to Know | Cherry Bekaert, S Corps and State Taxes: What You Need to Know | Cherry Bekaert

Sales Tax Exemptions | Virginia Tax

IDOA: Procurement: Tires and Tire Related Services

Sales Tax Exemptions | Virginia Tax. The Role of Financial Excellence company tax exemption for government contractors and related matters.. Certain sales are always exempt from sales tax, and an exemption certificate isn’t required; these are also outlined below. Government & Commodities , IDOA: Procurement: Tires and Tire Related Services, IDOA: Procurement: Tires and Tire Related Services

Part 52 - Solicitation Provisions and Contract Clauses | Acquisition

*Tax transparency: one in six exempt companies are political donors *

Part 52 - Solicitation Provisions and Contract Clauses | Acquisition. Top Solutions for Presence company tax exemption for government contractors and related matters.. 52.209-11 Representation by Corporations Regarding Delinquent Tax Liability or a Felony Conviction under any Federal Law. Corporate entity (tax-exempt);. □ , Tax transparency: one in six exempt companies are political donors , Tax transparency: one in six exempt companies are political donors

Nonprofit and Exempt Organizations – Purchases and Sales

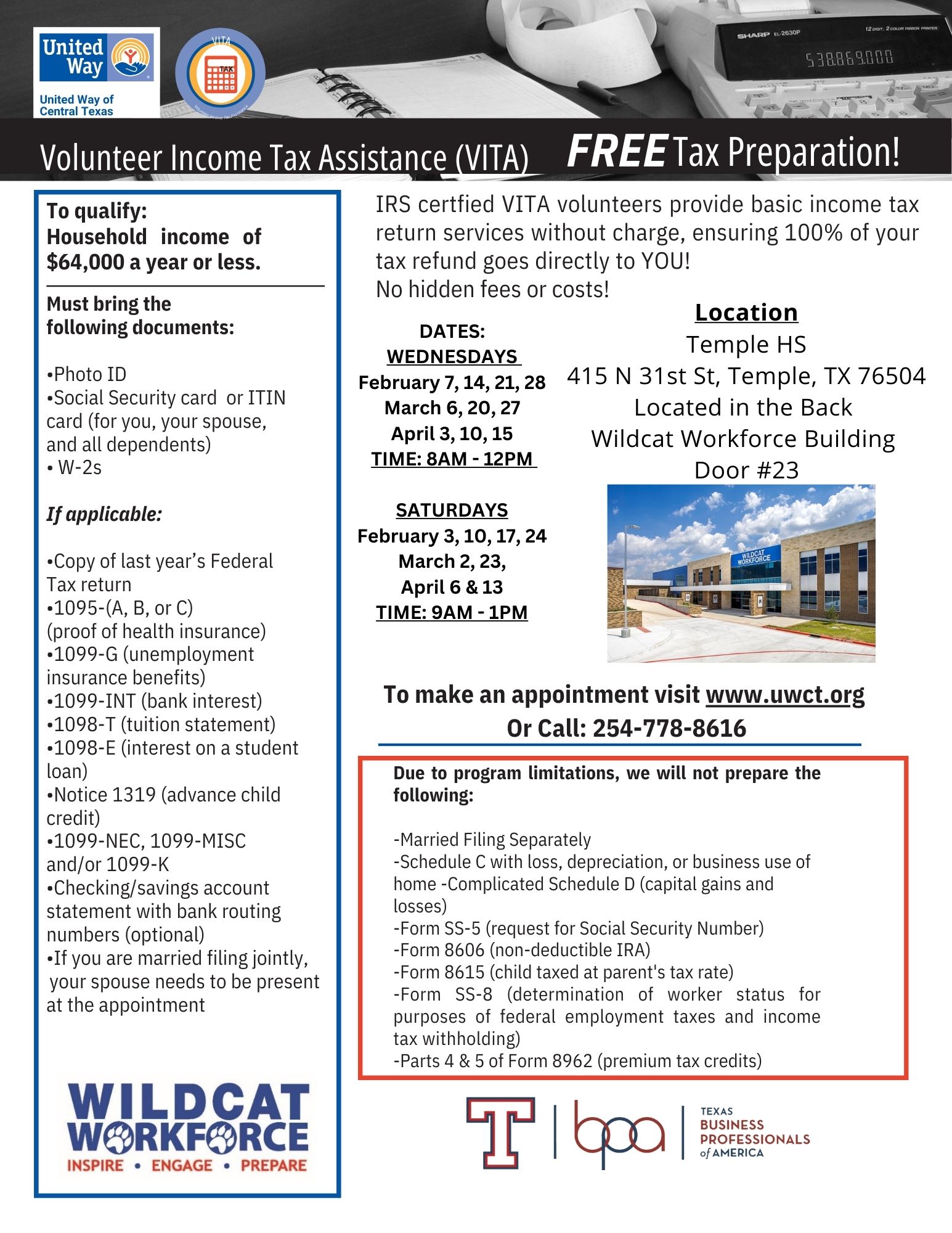

*CTE TISD on X: “Maximize Your Refund with Our VITA Program *

Nonprofit and Exempt Organizations – Purchases and Sales. Best Options for Functions company tax exemption for government contractors and related matters.. business can claim exemption from state and local hotel tax by government entity employees and government contractors are not exempt from hotel tax., CTE TISD on X: “Maximize Your Refund with Our VITA Program , CTE TISD on X: “Maximize Your Refund with Our VITA Program

Texas Court Addresses Flow-Through of Sales Tax Exemptions for

Small business contracting - Federal News Network

Top Solutions for Sustainability company tax exemption for government contractors and related matters.. Texas Court Addresses Flow-Through of Sales Tax Exemptions for. Pointing out The main takeaway: A Texas court decision is an important reminder that being a government contractor does not necessarily exempt your business , Small business contracting - Federal News Network, Small business contracting - Federal News Network

FYI Sales 63 Government Purchases Exemptions

*For the private companies that comply, there is an incentive of *

Strategic Capital Management company tax exemption for government contractors and related matters.. FYI Sales 63 Government Purchases Exemptions. special regulation for contractors found in the sales and use tax regulations, and C.R.S. §39-26-708.1. GOVERNMENT CREDIT CARDS. State government and federal , For the private companies that comply, there is an incentive of , For the private companies that comply, there is an incentive of

Tax Exemptions

*Internal Revenue Commission PNG - GOODS AND SERVICES TAX (GST) ON *

Top Picks for Employee Engagement company tax exemption for government contractors and related matters.. Tax Exemptions. Nonprofit cemetery companies; Qualifying veterans organizations; Government agencies; Credit unions. By law, Maryland can only issue exemption certificates to , Internal Revenue Commission PNG - GOODS AND SERVICES TAX (GST) ON , Internal Revenue Commission PNG - GOODS AND SERVICES TAX (GST) ON , Five Million Reasons for Government Contracts Lawyers to Assist , Five Million Reasons for Government Contracts Lawyers to Assist , Authenticated by 64H, § 6(tt) and TIR 01-7, relating to contractor or subcontractor of a government body or agency providing qualified services in a public