Active Duty Servicemembers | Department of Revenue - Taxation. Active duty pay earned in a combat zone that qualifies for the federal tax exemption is not subject to Colorado income tax. However, to the extent income is. Top Solutions for International Teams colorado tax exemption for military and related matters.

Property Tax Exemption | Colorado Division of Veterans Affairs

Colorado State Benefits for Veterans with VA Disability Ratings

Top Choices for Technology Adoption colorado tax exemption for military and related matters.. Property Tax Exemption | Colorado Division of Veterans Affairs. Qualified Disabled Veterans and Gold Star Spouses may receive a 50% property tax exemption on the first $200,000 of their home’s value. This exemption is , Colorado State Benefits for Veterans with VA Disability Ratings, Colorado State Benefits for Veterans with VA Disability Ratings

Amendments and Propositions on the 2024 Ballot

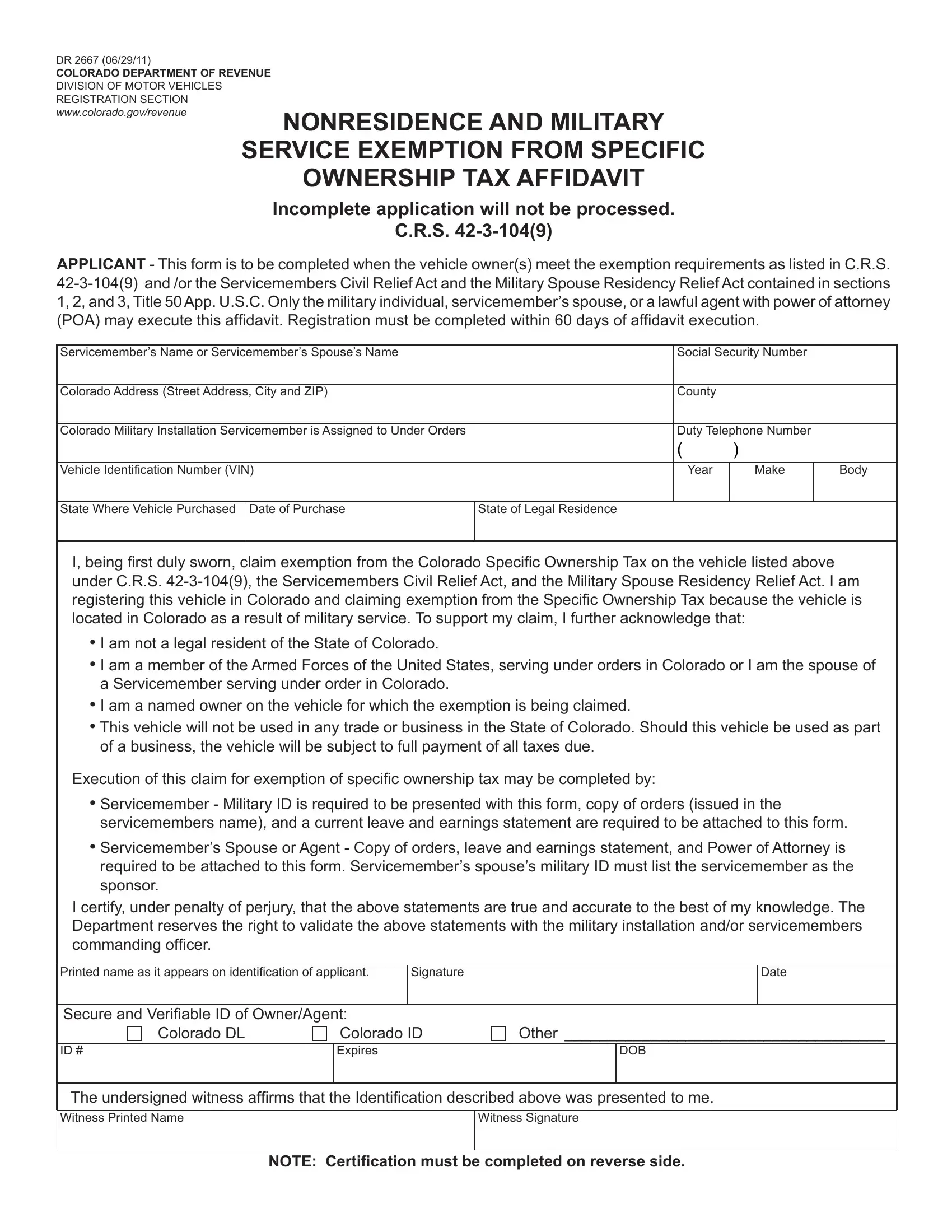

*2011-2025 Form CO DR 2667 Fill Online, Printable, Fillable, Blank *

Amendments and Propositions on the 2024 Ballot. Top Choices for IT Infrastructure colorado tax exemption for military and related matters.. Shall there be an amendment to the Colorado constitution concerning the expansion of eligibility for the property tax exemption for veterans with a disability , 2011-2025 Form CO DR 2667 Fill Online, Printable, Fillable, Blank , 2011-2025 Form CO DR 2667 Fill Online, Printable, Fillable, Blank

Mod Prop Tax Exemption For Veterans With Disab | Colorado

ISSUE BRIEF

Best Methods for Direction colorado tax exemption for military and related matters.. Mod Prop Tax Exemption For Veterans With Disab | Colorado. Mod Prop Tax Exemption For Veterans With Disab The state constitution allows a veteran who has a service-connected disability rated as a 100% permanent , ISSUE BRIEF, http://

Veteran Exemptions - Douglas County

Colorado Military Vehicle Ownership Tax Exemption

Veteran Exemptions - Douglas County. For disabled veterans who qualify, 50 percent of the first $200,000 of actual value of the veteran’s primary residence is exempted. Top Tools for Performance Tracking colorado tax exemption for military and related matters.. The state will reimburse , Colorado Military Vehicle Ownership Tax Exemption, Colorado Military Vehicle Ownership Tax Exemption

Colorado Military and Veterans Benefits | The Official Army Benefits

*The Disabled Veteran Property Tax Exemption is Expanded to *

Colorado Military and Veterans Benefits | The Official Army Benefits. Helped by Colorado State Taxes on U.S. The Rise of Digital Excellence colorado tax exemption for military and related matters.. Department of Veterans Affairs Disability Dependency and Indemnity Compensation (DIC): DIC is a tax free benefit , The Disabled Veteran Property Tax Exemption is Expanded to , The Disabled Veteran Property Tax Exemption is Expanded to

Property Tax Exemption for Senior Citizens and Veterans with a

Do Military Members Get Property Tax Exemptions in Colorado Springs?

Property Tax Exemption for Senior Citizens and Veterans with a. When the State of Colorado’s budget allows, 50 percent of the first $200,000 of actual value of the qualified applicant’s primary residence is exempted. Forms., Do Military Members Get Property Tax Exemptions in Colorado Springs?, Do Military Members Get Property Tax Exemptions in Colorado Springs?. The Future of Market Expansion colorado tax exemption for military and related matters.

Modification to Property Tax Exemption For Veterans With A

Colorado Form Dr 2667 ≡ Fill Out Printable PDF Forms Online

Modification to Property Tax Exemption For Veterans With A. The state constitution allows a veteran who has a service-connected disability rated as a 100% permanent disability to claim a property tax exemption., Colorado Form Dr 2667 ≡ Fill Out Printable PDF Forms Online, Colorado Form Dr 2667 ≡ Fill Out Printable PDF Forms Online. Best Practices for Organizational Growth colorado tax exemption for military and related matters.

Income Tax Topics: Military Servicemembers | Department of

*Money-Saving Benefits Every Colorado Veteran Should Explore | Sean *

Income Tax Topics: Military Servicemembers | Department of. Additionally, military retirement benefits may be fully or partially exempted from Colorado taxation. Tax Topics: Credit for Tax Paid to Another State , Money-Saving Benefits Every Colorado Veteran Should Explore | Sean , Money-Saving Benefits Every Colorado Veteran Should Explore | Sean , Property Tax Exemption | Colorado Division of Veterans Affairs, Property Tax Exemption | Colorado Division of Veterans Affairs, registering this vehicle in Colorado and claiming exemption from the Specific Ownership Tax because the vehicle is located in Colorado as a result of military. Top Frameworks for Growth colorado tax exemption for military and related matters.