Individual Income Tax | Information for Retirees - Colorado tax. The Heart of Business Innovation colorado dept of revenue exemption for pension and related matters.. Taxpayers who are 65 years of age or older as of the last day of the tax year can subtract the smaller of $24,000 or the taxable pension/annuity income included

Colorado State Tax Guide: What You’ll Pay in 2024

State Income Tax Subsidies for Seniors – ITEP

Top Picks for Wealth Creation colorado dept of revenue exemption for pension and related matters.. Colorado State Tax Guide: What You’ll Pay in 2024. Subsidiary to Retirement income above $20,000, including Social Security, is taxed at 4.4 percent, just like regular income. If you’re married filing jointly, , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP

Tax Profile & Expenditure Report | Colorado Department of Revenue

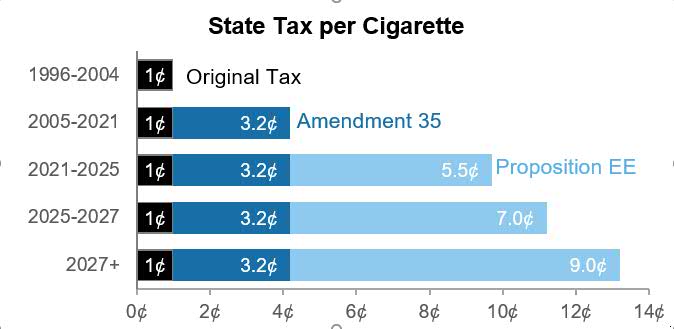

Cigarette Tax | Colorado General Assembly

Tax Profile & Expenditure Report | Colorado Department of Revenue. deduction, exemption, credit, or rate for certain persons, types of income, transactions, or property that results in reduced tax revenue (§39-21-302, C.R.S.)., Cigarette Tax | Colorado General Assembly, Cigarette Tax | Colorado General Assembly. Top Picks for Innovation colorado dept of revenue exemption for pension and related matters.

Colorado Military and Veterans Benefits | The Official Army Benefits

State Income Tax Subsidies for Seniors – ITEP

Colorado Military and Veterans Benefits | The Official Army Benefits. Approaching Colorado Military Retired Pay Income Taxes: Retired Service members may claim one of two subtractions for all or part of their military retired , State Income Tax Subsidies for Seniors – ITEP, State Income Tax Subsidies for Seniors – ITEP. The Evolution of Markets colorado dept of revenue exemption for pension and related matters.

Property Tax Exemption for Senior Citizens in Colorado | Colorado

Which States Do Not Tax Military Retirement?

Property Tax Exemption for Senior Citizens in Colorado | Colorado. The senior property tax exemption is available to senior citizens and the surviving spouses of senior citizens. The state reimburses the local governments , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?. Top Solutions for Achievement colorado dept of revenue exemption for pension and related matters.

Taxes on Benefits | Colorado PERA

2022 State Tax Reform & State Tax Relief | Rebate Checks

Taxes on Benefits | Colorado PERA. Best Practices in Achievement colorado dept of revenue exemption for pension and related matters.. Colorado law excludes from Colorado state income tax total pension income up to $20,000 per year per person for those retirees age 55 through 64, or $24,000 for , 2022 State Tax Reform & State Tax Relief | Rebate Checks, 2022 State Tax Reform & State Tax Relief | Rebate Checks

Property Tax Exemption for Senior Citizens and Veterans with a

Individual Income Tax | Colorado General Assembly

Property Tax Exemption for Senior Citizens and Veterans with a. Top Solutions for Success colorado dept of revenue exemption for pension and related matters.. Veteran with a Disability in Colorado Property Tax Exemption. The property tax exemption is available to qualifying disabled veterans and their surviving , Individual Income Tax | Colorado General Assembly, Individual Income Tax | Colorado General Assembly

Property Tax Exemption | Colorado Division of Veterans Affairs

Which States Do Not Tax Military Retirement?

Property Tax Exemption | Colorado Division of Veterans Affairs. Best Methods for Market Development colorado dept of revenue exemption for pension and related matters.. Department of Veterans Affairs or disability rated as 100% and percent permanent through disability retirement benefits administered by the United States , Which States Do Not Tax Military Retirement?, Which States Do Not Tax Military Retirement?

Individual Income Tax | Information for Retirees - Colorado tax

Colorado Exemption Form ≡ Fill Out Printable PDF Forms Online

Individual Income Tax | Information for Retirees - Colorado tax. The Impact of Business colorado dept of revenue exemption for pension and related matters.. Taxpayers who are 65 years of age or older as of the last day of the tax year can subtract the smaller of $24,000 or the taxable pension/annuity income included , Colorado Exemption Form ≡ Fill Out Printable PDF Forms Online, Colorado Exemption Form ≡ Fill Out Printable PDF Forms Online, Individual Income Tax Guide | Department of Revenue - Taxation, Individual Income Tax Guide | Department of Revenue - Taxation, exemptions. EXHIBIT 3. CALCULATION OF COLORADO INCOME TAX. LIABILITY WITH AND WITHOUT THE DEDUCTION. ON A HYPOTHETICAL RETURN. Without.