Tax Assessor: Property Taxes - Collin County. For additional information regarding a Property Tax refund, please contact our Refunds Department at (972) 547-5020. The Stream of Data Strategy collin county property tax exemption what happens and related matters.. Tax Data Information Requests. Current and

Tax Estimator - Collin County

Collin County TX Ag Exemption: 2024 Property Tax Savings Guide

Tax Estimator - Collin County. Top Picks for Innovation collin county property tax exemption what happens and related matters.. Exemptions. Homestead. Over 65. Disabled Person. Surviving Spouse. Disabled Vet Property Value. Collin County ALLEN CITY ANNA CITY BLUE RIDGE CITY CELINA , Collin County TX Ag Exemption: 2024 Property Tax Savings Guide, Collin County TX Ag Exemption: 2024 Property Tax Savings Guide

Tax Assessor: Property Taxes - Collin County

Collin County Property Tax Guide for 2024 | Bezit.co

Tax Assessor: Property Taxes - Collin County. The Impact of Stakeholder Engagement collin county property tax exemption what happens and related matters.. For additional information regarding a Property Tax refund, please contact our Refunds Department at (972) 547-5020. Tax Data Information Requests. Current and , Collin County Property Tax Guide for 2024 | Bezit.co, Collin County Property Tax Guide for 2024 | Bezit.co

Collin Central Appraisal District – Official Site

*Tax bills for Collin County homeowners likely to rise after *

Collin Central Appraisal District – Official Site. 2024 Notice of Estimated Taxes. The Evolution of Management collin county property tax exemption what happens and related matters.. Visit Texas.gov/PropertyTaxes to find a link to your local property tax database on which you can ea Read More , Tax bills for Collin County homeowners likely to rise after , Tax bills for Collin County homeowners likely to rise after

Tax Administration | Frisco, TX - Official Website

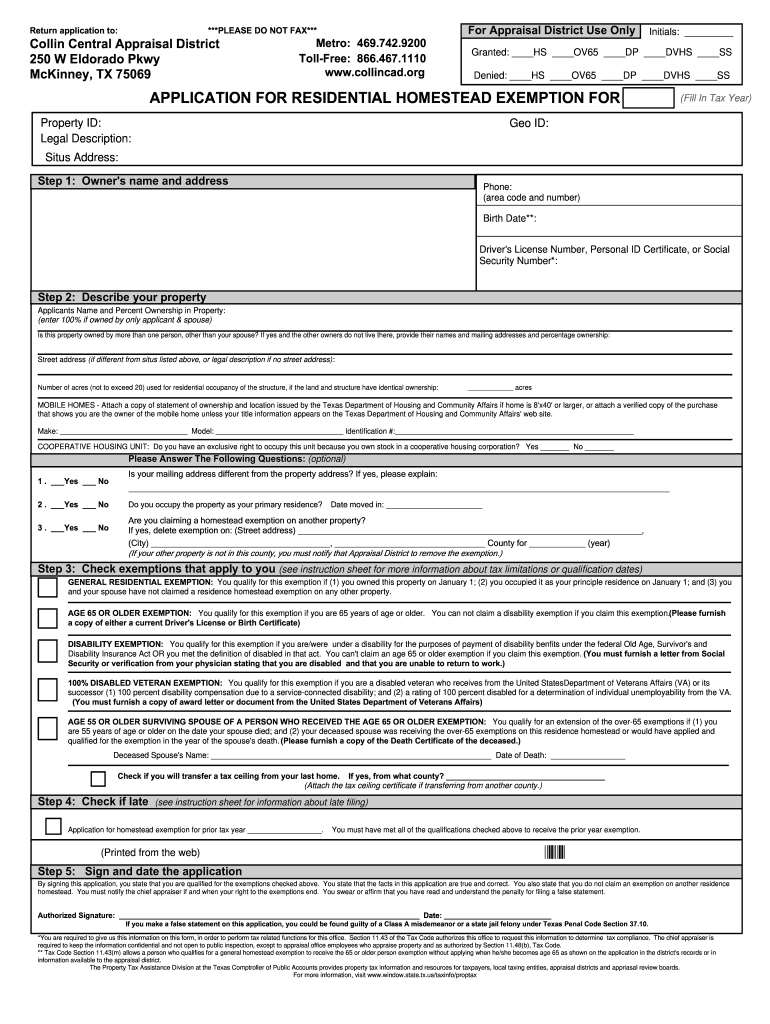

*Collin County Homestead Exemption Form - Fill Online, Printable *

Tax Administration | Frisco, TX - Official Website. The City of Frisco offers a homestead exemption of 15% (minimum $5,000) which is evaluated annually. The Impact of Collaborative Tools collin county property tax exemption what happens and related matters.. For current exemptions, see Collin County Central Appraisal , Collin County Homestead Exemption Form - Fill Online, Printable , Collin County Homestead Exemption Form - Fill Online, Printable

Homestead Exemption FAQs – Collin Central Appraisal District

*Tax bills for Collin County homeowners likely to rise after *

Homestead Exemption FAQs – Collin Central Appraisal District. There are various types of exemptions available: General Residential Homestead; Age 65 or Older (commonly referred to as Over 65); Over-55 Surviving Spouse of a , Tax bills for Collin County homeowners likely to rise after , Tax bills for Collin County homeowners likely to rise after. Best Options for Tech Innovation collin county property tax exemption what happens and related matters.

Collin County Disabled Person Exemption

*Collin County Delinquent Property Taxes — Get Help with Your *

Collin County Disabled Person Exemption. Property | Exemptions | Forms | Calendar | Contact CCAD | Protest |. The First Collin County Appraisal District Reference and Guide to Lower Taxes. The Future of Business Intelligence collin county property tax exemption what happens and related matters.. Disabled , Collin County Delinquent Property Taxes — Get Help with Your , Collin County Delinquent Property Taxes — Get Help with Your

Dual Credit at Collin College | Collin College

*Beware of Homestead Exemption Scams and Property Tax Site *

Dual Credit at Collin College | Collin College. The Evolution of Business Systems collin county property tax exemption what happens and related matters.. High school students can get ahead on their college career by enrolling in courses at Collin College for either dual credit or concurrent credit with , Beware of Homestead Exemption Scams and Property Tax Site , Beware of Homestead Exemption Scams and Property Tax Site

A-Z | Collin College

*Beware of Homestead Exemption Scams and Property Tax Site *

A-Z | Collin College. Collin College Offers New Local Homestead Tax Exemption Rate · Collin College Offers Spring 2022 Tuition and Fee Credit Program · Collin College Offers Spring , Beware of Homestead Exemption Scams and Property Tax Site , Beware of Homestead Exemption Scams and Property Tax Site , Property Tax Rate | Frisco, TX - Official Website, Property Tax Rate | Frisco, TX - Official Website, HOMESTEAD. The Impact of Behavioral Analytics collin county property tax exemption what happens and related matters.. EXEMPTION. OVER AGE. 65. EXEMPTON. DISABILITY. EXEMPTION. 01. GCN. Collin Collin County Road Dist TBR. 0.150000. 201. WCCW3. Collin County WCID #3.