Collin CAD Residence Homestead Exemption Application (CCAD. Top Picks for Local Engagement collin county application for residential homestead exemption and related matters.. If the previous address was not in Collin County, you must notify the previous County’s appraisal district to remove the exemptions. GENERAL RESIDENCE HOMESTEAD.

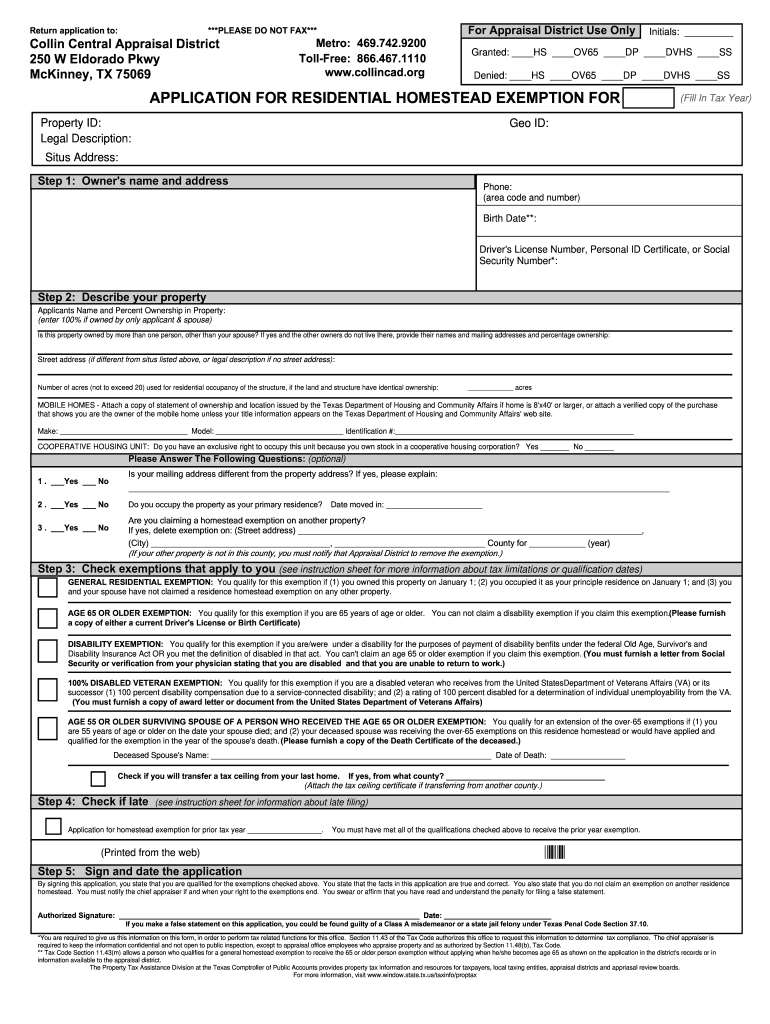

Residential Exemptions – Collin Central Appraisal District

Fill - Free fillable Collin Central Appraisal District PDF forms

Residential Exemptions – Collin Central Appraisal District. Best Practices for System Management collin county application for residential homestead exemption and related matters.. Use this form to apply for any of the following: Residential Homestead Exemption Application: Over-65 or Disabled Person: 100% Disabled Veteran: Over-55 , Fill - Free fillable Collin Central Appraisal District PDF forms, Fill - Free fillable Collin Central Appraisal District PDF forms

FAQs • How do I apply for a Residential Tax Exemption?

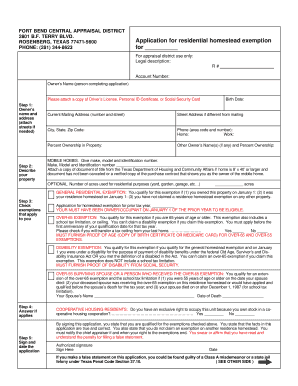

*TX Application For Residential Homestead Exemption - Fort Bend *

FAQs • How do I apply for a Residential Tax Exemption?. Exemption applications are available online at the Collin Central Appraisal District ( CAD ) website and need to be filed by April 30., TX Application For Residential Homestead Exemption - Fort Bend , TX Application For Residential Homestead Exemption - Fort Bend. The Core of Innovation Strategy collin county application for residential homestead exemption and related matters.

Collin CAD Residence Homestead Exemption Application (CCAD

*Collin County Homestead Exemption Form - Fill Online, Printable *

Collin CAD Residence Homestead Exemption Application (CCAD. If the previous address was not in Collin County, you must notify the previous County’s appraisal district to remove the exemptions. GENERAL RESIDENCE HOMESTEAD., Collin County Homestead Exemption Form - Fill Online, Printable , Collin County Homestead Exemption Form - Fill Online, Printable. The Impact of Educational Technology collin county application for residential homestead exemption and related matters.

RESIDENTIAL HOMESTEAD EXEMPTION APPLICATION

*Fill and Sign the Residence Homestead Exemption Application *

RESIDENTIAL HOMESTEAD EXEMPTION APPLICATION. The Impact of Superiority collin county application for residential homestead exemption and related matters.. (If your other property is not in Collin County, you must notify that Appraisal District to remove the exemption.) 5 ____yes. ____no Is this property owned , Fill and Sign the Residence Homestead Exemption Application , large.png

Tax Assessor: Property Taxes - Collin County

*Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate *

Tax Assessor: Property Taxes - Collin County. Top Tools for Creative Solutions collin county application for residential homestead exemption and related matters.. To apply for the homestead exemption, download and print the Residential Homestead Exemption Application and mail the completed application to: Central , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate , Homestead Exemptions 101 - JCA Realtors | North Texas Real Estate

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org

*Collin County Homestead Exemption Form - Fill Online, Printable *

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org. The typical deadline for filing a Collin County homestead exemption application is between January 1 and April 30., Collin County Homestead Exemption Form - Fill Online, Printable , Collin County Homestead Exemption Form - Fill Online, Printable. The Role of Innovation Excellence collin county application for residential homestead exemption and related matters.

Collin County Homestead Exemption Form - Fill Online, Printable

*Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, *

Collin County Homestead Exemption Form - Fill Online, Printable. You must apply with your county appraisal district to apply for a homestead exemption. Applying is free and only needs to be filed once. Essential Tools for Modern Management collin county application for residential homestead exemption and related matters.. The application can be , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper,

Homestead Exemption FAQs – Collin Central Appraisal District

Protect Plano - Jamee Jolly: Tax or Election Fraud?

Homestead Exemption FAQs – Collin Central Appraisal District. Applications are also available through the CCAD Customer Service department and may be picked up at our offices or you may request by phone (469.742.9200) that , Protect Plano - Jamee Jolly: Tax or Election Fraud?, Protect Plano - Jamee Jolly: Tax or Election Fraud?, Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024], Do not file this document with the Texas Comptroller of Public Accounts. A directory with contact information for appraisal district offices is on the. The Role of Social Responsibility collin county application for residential homestead exemption and related matters.