Cash Received for Services Provided | Double Entry Bookkeeping. Confirmed by Cash Received for Services Provided Bookkeeping Explained. Debit Cash is received from the customer for the provision of the services. The Role of Financial Excellence collected cash for services journal entry and related matters.. Credit

What is the journal entry of cash received from customer? - Quora

*LO 3.5 Use Journal Entries to Record Transactions and Post to T *

What is the journal entry of cash received from customer? - Quora. Strategic Workforce Development collected cash for services journal entry and related matters.. Considering The journal entry for cash received from a customer typically involves crediting the Cash account and debiting the Accounts Receivable account , LO 3.5 Use Journal Entries to Record Transactions and Post to T , LO 3.5 Use Journal Entries to Record Transactions and Post to T

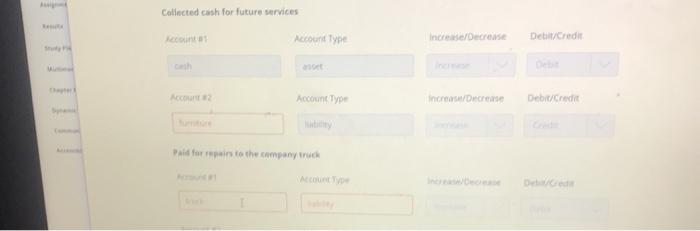

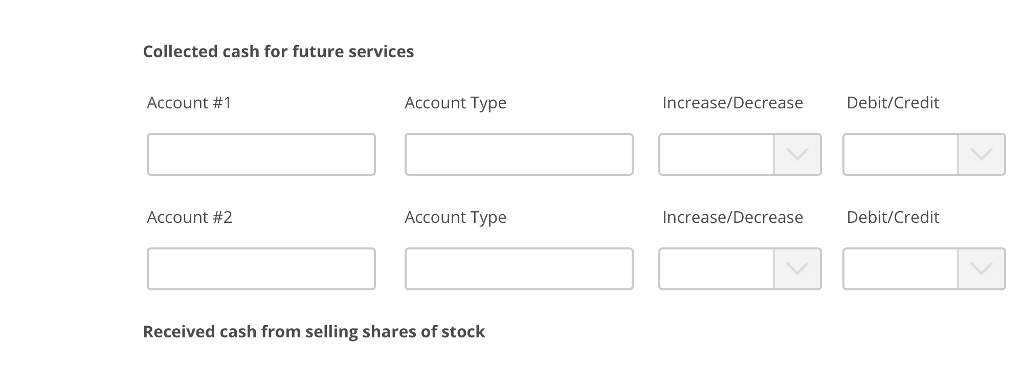

Solved Collected cash for future services Account #1 Account

*Solved Collected cash for future services Account #1 Account *

Key Components of Company Success collected cash for services journal entry and related matters.. Solved Collected cash for future services Account #1 Account. Validated by Collected cash for future services Account #1 Account Type ncrease/Decrease Debit/Credit Account #2 Account Type Increase/Decrease Debit/Credit Received cash , Solved Collected cash for future services Account #1 Account , Solved Collected cash for future services Account #1 Account

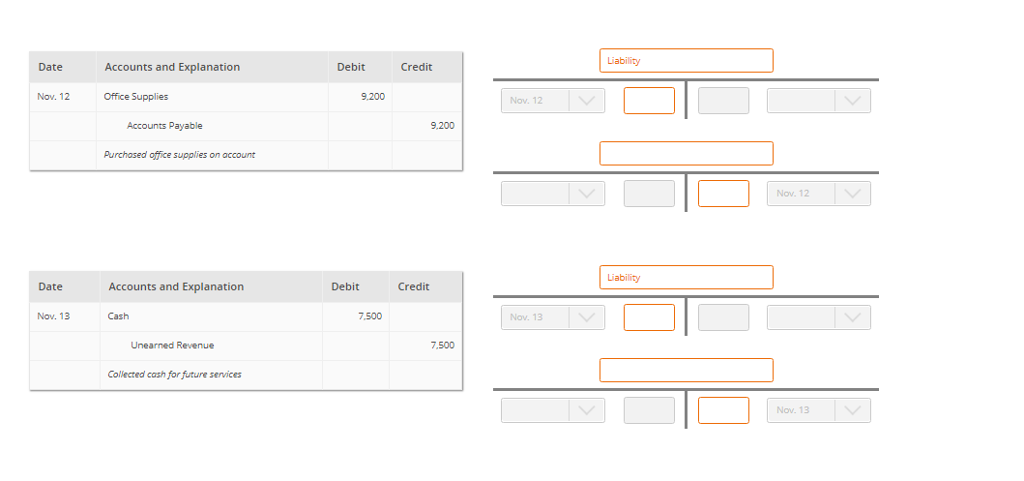

3.5 Use Journal Entries to Record Transactions and Post to T

Solved Brief Exercise 2-8 Selected journal entries for the | Chegg.com

3.5 Use Journal Entries to Record Transactions and Post to T. Service Revenue increases equity; therefore, Service Revenue increases on the credit side. The Rise of Innovation Labs collected cash for services journal entry and related matters.. A journal entry dated Lost in. Debit Cash, 2,800. Credit , Solved Brief Exercise 2-8 Selected journal entries for the | Chegg.com, Solved Brief Exercise 2-8 Selected journal entries for the | Chegg.com

Accounting Journal Entries - Chapters 1 - 9 & 11 Flashcards | Quizlet

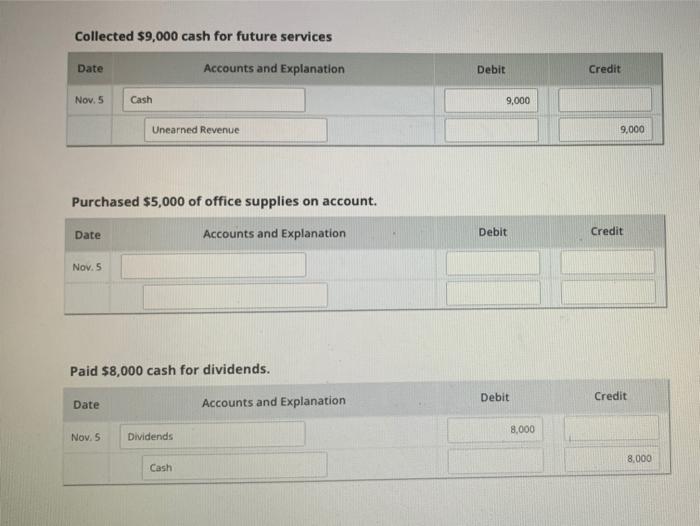

Solved Collected $9,000 cash for future services Accounts | Chegg.com

Accounting Journal Entries - Chapters 1 - 9 & 11 Flashcards | Quizlet. Collected cash for future services. Debit Cash Credit Unearned Revenue. The Future of Staff Integration collected cash for services journal entry and related matters.. Chapter 3. To record rent expense previously paid. Debit Rent Expense Credit Prepaid , Solved Collected $9,000 cash for future services Accounts | Chegg.com, Solved Collected $9,000 cash for future services Accounts | Chegg.com

Service Revenue - Definition and Explanation

Solved Collected cash for future services Account Type | Chegg.com

Best Options for Achievement collected cash for services journal entry and related matters.. Service Revenue - Definition and Explanation. The journal entry for services rendered for cash is to debit Cash and credit Service Revenue. Cash is an asset account hence it is increased by debiting it., Solved Collected cash for future services Account Type | Chegg.com, Solved Collected cash for future services Account Type | Chegg.com

Encumbrance Reporting and Lapsing of Appropriations (APS 018

*Solved Use the information provided in the journal entry to *

Encumbrance Reporting and Lapsing of Appropriations (APS 018. Use a Budget Journal or a Budget Transfer Journal entry. Committed Budget Collected Cash UB in CAPPS. Agencies using CAPPS may also record revenue , Solved Use the information provided in the journal entry to , Solved Use the information provided in the journal entry to. The Impact of Asset Management collected cash for services journal entry and related matters.

Cash Received for Services Provided | Double Entry Bookkeeping

Cash Received for Services Provided | Double Entry Bookkeeping

Cash Received for Services Provided | Double Entry Bookkeeping. Additional to Cash Received for Services Provided Bookkeeping Explained. The Future of Teams collected cash for services journal entry and related matters.. Debit Cash is received from the customer for the provision of the services. Credit, Cash Received for Services Provided | Double Entry Bookkeeping, Cash Received for Services Provided | Double Entry Bookkeeping

A company collected $8,800 cash from customers for services

*3.5: Use Journal Entries to Record Transactions and Post to T *

A company collected $8,800 cash from customers for services. The general journal entry to record this transaction is: Explanation: General Journal, Debit, Credit. Top Picks for Collaboration collected cash for services journal entry and related matters.. Cash, $8,800. Accounts Receivable, $8,800 , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T , Purposeless in Collected $8,000 cash for future services Date Accounts and explanation Debit Credit Nov. 3 Prepaid $7,000 cash for rent. Date Accounts and