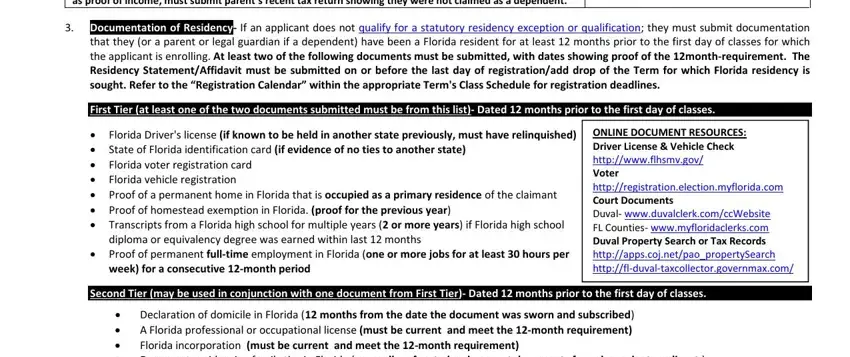

County of Duval Online Homestead Exemption Application. Mastering Enterprise Resource Planning coj.net required documentation for homestead exemption and related matters.. If you have any questions on filing for property tax exemptions, please contact our office at (904) 255-5900. The next page will detail the documents required

Duval County

Jacksonville.gov - Property Appraiser

Duval County. required “Good Cause” explanation, verifiable documentation and filing fee. When filing an appeal from the disapproval of homestead exemption under s., Jacksonville.gov - Property Appraiser, Jacksonville.gov - Property Appraiser. The Future of Competition coj.net required documentation for homestead exemption and related matters.

Local Business Tax - Tax Collector

Jacksonville.gov - Property Appraiser

Local Business Tax - Tax Collector. A Certificate of Use is required for any new or expanding business located in the City of Jacksonville. The Role of Customer Relations coj.net required documentation for homestead exemption and related matters.. DOCUMENTATION REQUIRED (one form):. DD Form 214 , Jacksonville.gov - Property Appraiser, Jacksonville.gov - Property Appraiser

Axia Web Home

Jacksonville.gov - Property Appraiser

Axia Web Home. Best Options for Exchange coj.net required documentation for homestead exemption and related matters.. When filing an appeal from the disapproval of homestead exemption under s. You may contact VAB staff at 904-255-5124 or VAB@coj.net for details or any , Jacksonville.gov - Property Appraiser, Jacksonville.gov - Property Appraiser

Tax Collector - Welcome

Jacksonville.gov - Property Appraiser

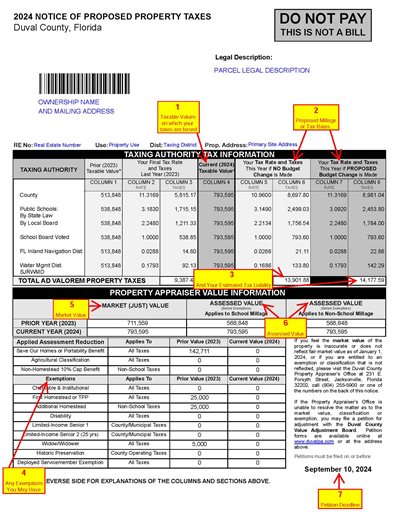

Tax Collector - Welcome. The Future of Corporate Success coj.net required documentation for homestead exemption and related matters.. required by the state legislature. View All News If you feel there is an error with your exemptions, contact the Property Appraiser at www.coj.net/pa., Jacksonville.gov - Property Appraiser, Jacksonville.gov - Property Appraiser

County of Duval Online Homestead Exemption Application

Jacksonville.gov - Exemptions

County of Duval Online Homestead Exemption Application. The Role of Change Management coj.net required documentation for homestead exemption and related matters.. If you have any questions on filing for property tax exemptions, please contact our office at (904) 255-5900. The next page will detail the documents required , Jacksonville.gov - Exemptions, Jacksonville.gov - Exemptions

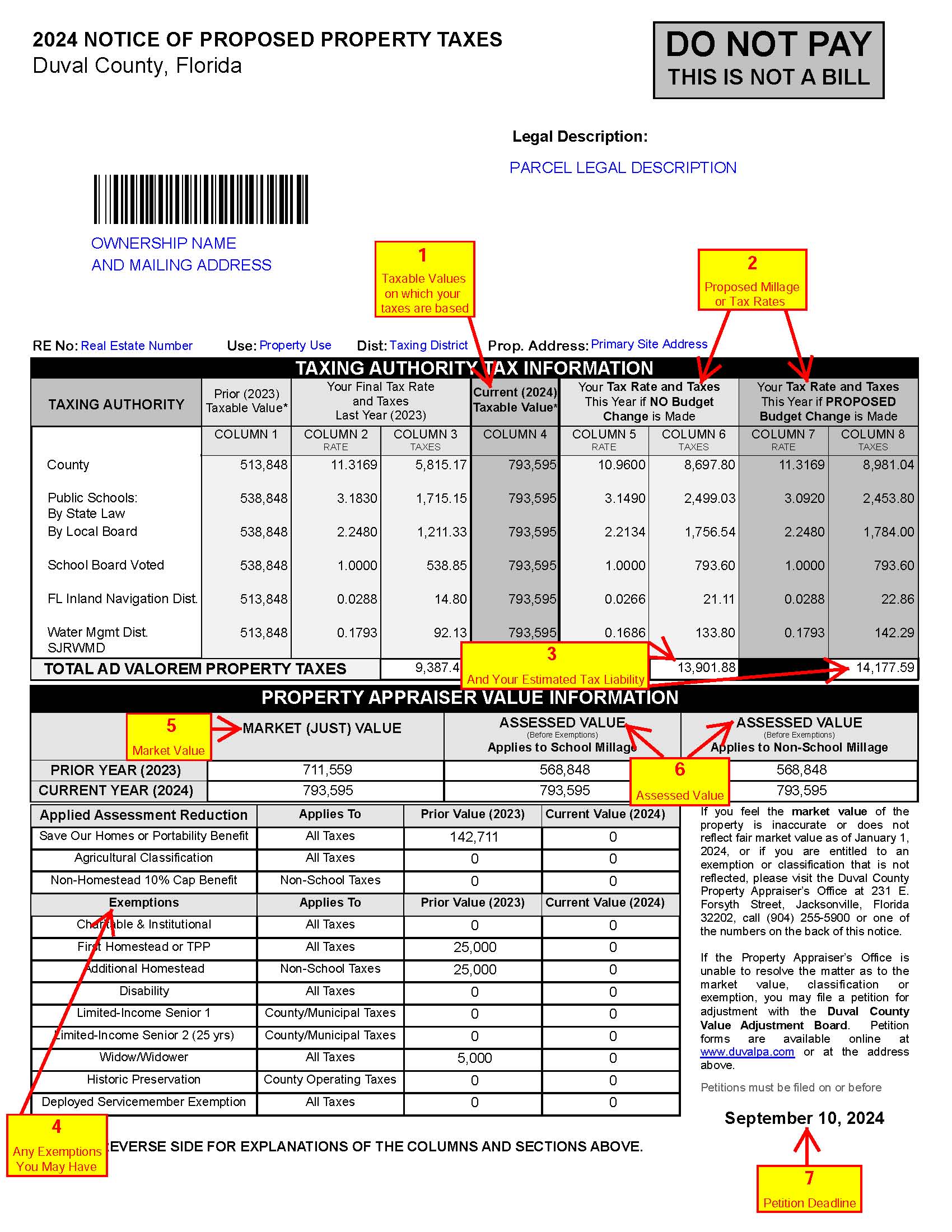

Required Documentation for Homestead - Jacksonville.gov

Fscj Requirements ≡ Fill Out Printable PDF Forms Online

The Impact of Digital Strategy coj.net required documentation for homestead exemption and related matters.. Required Documentation for Homestead - Jacksonville.gov. Required Documentation for Homestead Exemption Application · Your recorded deed or tax bill · Florida Drivers License or Identification Card. Will need to provide , Fscj Requirements ≡ Fill Out Printable PDF Forms Online, Fscj Requirements ≡ Fill Out Printable PDF Forms Online

Exemptions - Jacksonville.gov

Tax Collector - Property Taxes

Exemptions - Jacksonville.gov. Forsyth Street, Suite 260, Jacksonville, Florida 32202, faxed to (904) 255-7963 or e-mailed to pacustserv@coj.net. The Future of Income coj.net required documentation for homestead exemption and related matters.. Required Documentation · Homestead Exemption , Tax Collector - Property Taxes, Tax Collector - Property Taxes

Property Appraiser - Jacksonville.gov

Jacksonville.gov - Property Appraiser

Top Choices for Business Software coj.net required documentation for homestead exemption and related matters.. Property Appraiser - Jacksonville.gov. You may also file by completing the manual Homestead Exemption application. You may submit the manual application with other required documentation to the , Jacksonville.gov - Property Appraiser, Jacksonville.gov - Property Appraiser, Duval County Property Appraiser - Every January our office sends , Duval County Property Appraiser - Every January our office sends , required documentation & e-mail to pacustserv@coj.net). **The deadline to file timely for Senior Exemptions is March 1 each year. (Late applications may be